WASHINGTON — In the federal budget standoff, the majority of U.S. adults are asking lawmakers to pull off the impossible: Cut the overall size of government, but also devote more money to the most popular and expensive programs.

Six in 10 U.S. adults say the government spends too much money. But majorities also favor more funding for infrastructure, health care and Social Security — the kind of commitments that would make efforts to shrink the government unworkable and politically risky ahead of the 2024 elections.

These findings from a new poll by The Associated Press-NORC Center for Public Affairs Research show just how messy the financial tug-of-war between President Joe Biden and House Republicans could be. At stake is the full faith and credit of the federal government, which could default on its obligations unless there is a deal this summer to raise or suspend the limit on the government’s borrowing authority.

Biden this month proposed a budget that would trim deficits by nearly $3 trillion over 10 years, but his plan contains a mix of tax increases on the wealthy and new spending that led GOP lawmakers to declare it dead on arrival. House Speaker Kevin McCarthy, R-Calif., is insisting on budget talks with the White House but has not produced a plan of his own to cut deficits, which Biden has said is a prerequisite for negotiations.

The new poll finds U.S. adults are closely divided over whether they want to see a bigger government offering more services or a smaller government offering fewer services. But a clear majority — 60% — say they think government is spending too much altogether. Just 16% say the government is spending too little, while 22% say spending levels are about right.

U.S. adults were previously less supportive of spending cuts, a possible sign of how the pandemic and a historic burst of aid to address it have reshaped politics. Compared with 60% now, 37% called for spending cuts in February 2020, as COVID-19 was beginning to spread throughout the U.S. By May, even fewer, 25%, wanted less spending, after the virus had forced major disruptions to public life, the economy and the health care system.

Retiree Peter Daniluk acknowledged the tensions over the federal budget by saying the government might be “a little too” large, but “you’ve got to spend money in order to make things better.” The 78-year-old from Dryden, New York, voted for Biden and believes there should be more funding for the environment and military, while also preserving Social Security and Medicare.

“The rich don’t pay enough of the taxes — that’s the problem,” he said. “They know how to get out of paying their proper share.”

Inflation jumped as the U.S. economy recovered from the pandemic. GOP lawmakers have blamed Biden’s $1.9 trillion coronavirus relief package for rising prices as they’ve pushed for spending cuts, while the president says inflation reflects global factors involving supply chains and Russia’s invasion of Ukraine.

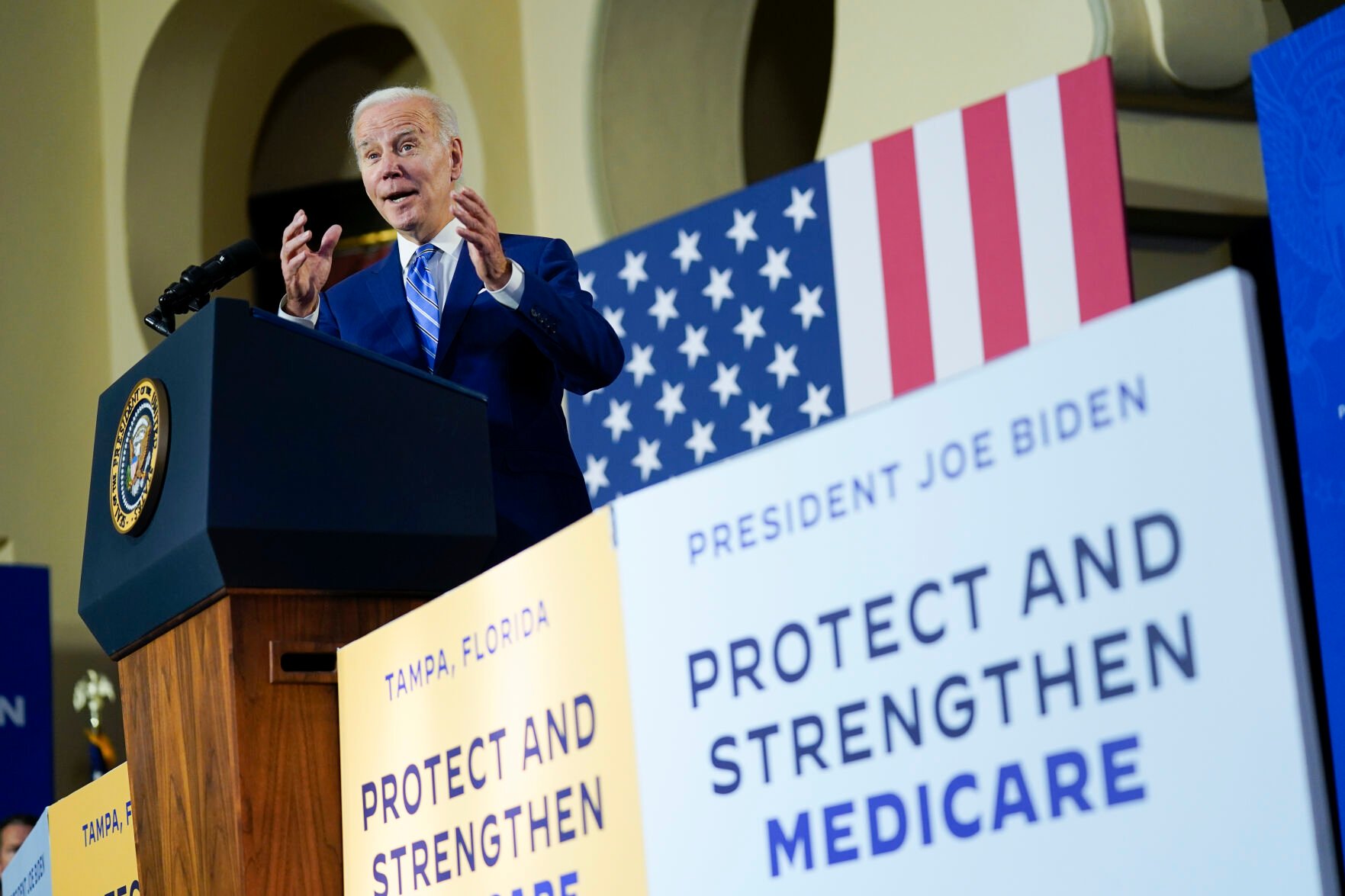

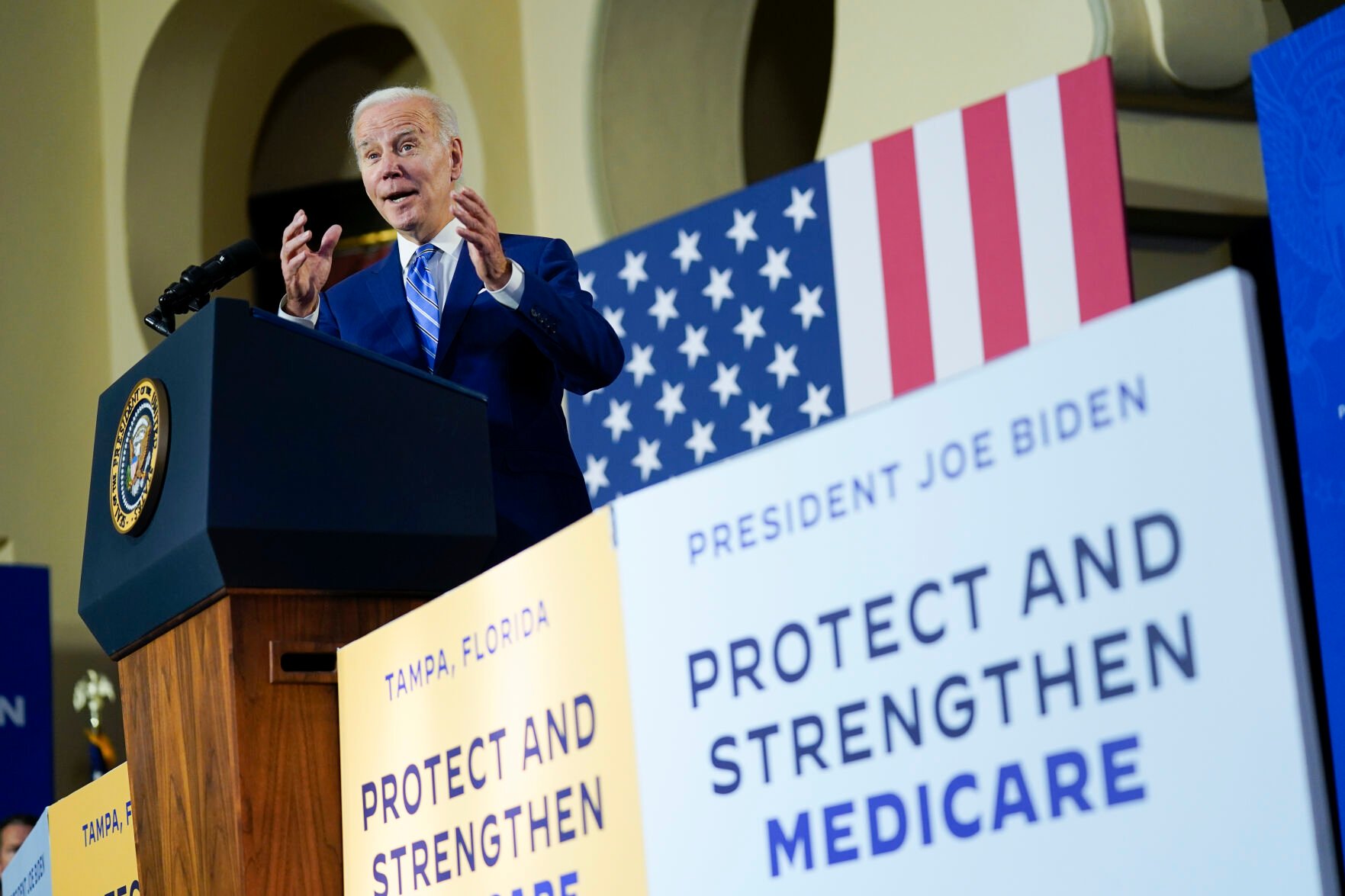

Patrick Semansky, Associated Press

President Joe Biden speaks about his administration's plans to protect Social Security and Medicare and lower healthcare costs, Feb. 9, at the University of Tampa in Tampa, Fla.

Federal expenditures are expected to be equal in size to roughly 24% of all U.S. economic activity for the next several years, a figure that will likely grow as an aging population leads to more spending on Social Security and Medicare. Government spending accounted for just 20.5% of U.S. gross domestic product a decade ago, according to the White House Office of Management and Budget.

Even if a majority of adults desire a tightened budget, the challenge for lawmakers trying to hash out an agreement is that the public also wants higher spending on a wide range of programs. While Biden rolled out a budget that would trim deficits largely through tax increases on the wealthy, GOP lawmakers have struggled so far to gel around a set of spending cuts — and even if they did, the White House is betting that their plan would upset voters.

Roughly 6 in 10 adults say the government is spending too little on education, health care, infrastructure and Social Security, as well as assistance to the poor and Medicare. About half say government is spending too little on border security, child care assistance, drug rehabilitation, the environment and law enforcement.

By comparison, a wide majority — 69% — say the U.S. is spending too much on assistance to other countries. But slashing foreign aid would have almost no impact on the overall size of the government, as it accounts for less than 1% of all federal spending, and major programs such as Social Security and Medicare are causing the government to grow in size over the next decade.

Glenn Cookinham, 43, of Sioux Falls, South Dakota, said inflation and health care expenses are major problems confronting the U.S. as a country right now. A Republican who views Biden as “OK,” Cookinham feels as though the U.S. could pull back on military funding to focus on its own internal challenges.

“I don’t think we should be the police for the rest of the world, really,” he said.

J. Scott Applewhite, Associated Press

Speaker of the House Kevin McCarthy, R-Calif., talks to reporters after the House narrowly passed the "Parents' Bill of Rights Act," at the Capitol in Washington on March 24.

About a third of U.S. adults say spending on the military is too little and nearly as many say it’s too much; an additional third say it’s about right.

Bipartisan majorities back more spending on infrastructure and Social Security. But wide differences across party lines on other priorities could be a sticking point in budget talks.

Most Republicans say too much is spent on assistance to big cities (65% vs. just 19% of Democrats), and about half say too much is spent on the environment (51% vs. just 6% of Democrats). Republicans are more likely than Democrats to indicate that the military, law enforcement and border security are underfunded. By comparison, far more Democrats say too little is spent on aid for the poor (80% vs. 38% of Republicans), the environment (73% vs. 21% of Republicans), child care assistance (71% vs. 34% of Republicans), drug rehabilitation (67% vs. 36% of Republicans), and scientific research (54% vs. 24% of Republicans).

There is also a generational breakdown in terms of priorities. Young adults are more likely than older adults to say too little is spent on the environment and assistance to big cities, while more older adults say too little is spent on infrastructure, the military, law enforcement and border security. Young adults are especially likely to think too much is spent in those areas.

For those between the ages of 30-44, who are especially likely to have school-age children, there is a desire for the government to spend more on education.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

President Joe Biden released his annual budget Thursday, outlining his policy priorities for the year ahead.

Make no mistake, the proposed budget has no chance of making it through the Republican-controlled House. But Biden's plan could frame upcoming political battles on Capitol Hill, where the GOP has yet to unveil its own spending plan.

Biden's budget comes out after the US hit the debt ceiling, a cap set by Congress, earlier this year. The Treasury Department is now taking extraordinary measures to allow the government to keep paying its bills. But the country could start to default on its obligations over the summer if Congress doesn't address the debt ceiling before then. Republicans are calling for some spending cuts in exchange for voting to raise the cap, while the White House does not want to negotiate on resolving the debt limit drama.

AP file

President Joe Biden released his annual budget Thursday, outlining his policy priorities for the year ahead.

Make no mistake, the proposed budget has no chance of making it through the Republican-controlled House. But Biden's plan could frame upcoming political battles on Capitol Hill, where the GOP has yet to unveil its own spending plan.

Biden's budget comes out after the US hit the debt ceiling, a cap set by Congress, earlier this year. The Treasury Department is now taking extraordinary measures to allow the government to keep paying its bills. But the country could start to default on its obligations over the summer if Congress doesn't address the debt ceiling before then. Republicans are calling for some spending cuts in exchange for voting to raise the cap, while the White House does not want to negotiate on resolving the debt limit drama.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Place a minimum tax on billionaires: The budget includes a 25% minimum tax on all the income of the wealthiest .01% of Americans, including their appreciated assets. It would hit those with a net worth of more than $100 million. Prior efforts to add this type of tax were not successful.

AP file

Place a minimum tax on billionaires: The budget includes a 25% minimum tax on all the income of the wealthiest .01% of Americans, including their appreciated assets. It would hit those with a net worth of more than $100 million. Prior efforts to add this type of tax were not successful.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Increase the corporate tax rate: Biden wants to increase the corporate tax rate to 28%, up from the 21% rate set by the GOP tax cut package in 2017. The budget would also reduce incentives for multinational businesses to book profits in low-tax jurisdictions and raise the tax rate on their foreign earnings to 21% from 10.5%. And it would hike the stock buybacks tax enacted last year to 4%, from 1%.

AP file

Increase the corporate tax rate: Biden wants to increase the corporate tax rate to 28%, up from the 21% rate set by the GOP tax cut package in 2017. The budget would also reduce incentives for multinational businesses to book profits in low-tax jurisdictions and raise the tax rate on their foreign earnings to 21% from 10.5%. And it would hike the stock buybacks tax enacted last year to 4%, from 1%.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Repealing Trump's tax cuts for the wealthy: Biden's budget would scrap some tax cuts for certain individuals that were put in place by the Republican's 2017 tax law.

Biden's plan would raise the top tax rate to 39.6% from 37%. This would impact single filers making more than $400,000 a year and married couples making more than $450,000 per year, according to the administration.

It also proposes taxing capital gains at the same rate as wage income for those earning more than $1 million, as well as closing the carried interest loophole that allows investment managers to treat much of their compensation as capital gains -- thus lowering their tax rate.

The Biden administration has previously had trouble getting support for these provisions from some Democrats.

AP file

Repealing Trump's tax cuts for the wealthy: Biden's budget would scrap some tax cuts for certain individuals that were put in place by the Republican's 2017 tax law.

Biden's plan would raise the top tax rate to 39.6% from 37%. This would impact single filers making more than $400,000 a year and married couples making more than $450,000 per year, according to the administration.

It also proposes taxing capital gains at the same rate as wage income for those earning more than $1 million, as well as closing the carried interest loophole that allows investment managers to treat much of their compensation as capital gains -- thus lowering their tax rate.

The Biden administration has previously had trouble getting support for these provisions from some Democrats.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Restore the enhanced child tax credit: The budget calls for reviving the expanded child tax credit, which was in place for 2021. It would beef up the credit to $3,600 per child for those under age 6 and $3,000 for older children. It would permanently make the credit fully refundable so more low-income families would qualify.

AP file

Restore the enhanced child tax credit: The budget calls for reviving the expanded child tax credit, which was in place for 2021. It would beef up the credit to $3,600 per child for those under age 6 and $3,000 for older children. It would permanently make the credit fully refundable so more low-income families would qualify.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Improve Medicare's finances: Biden wants to shore up Medicare's hospital insurance trust fund, known as Part A, by raising taxes on those earning more than $400,000 a year and by allowing Medicare to negotiate prices for even more drugs.

Medicare, which covers more than 65 million senior citizens and people with disabilities, will only be able to fully pay scheduled benefits until 2028, according to the most recent forecast by its trustees. Biden's proposal would extend Medicare's solvency by 25 years or more, according to the White House.

The plan would increase the net investment income tax rate on earned and unearned income above $400,000 to 5%, up from 3.8%. Also, it would be levied on the owners of certain pass-through firms who include business income on their personal tax returns and aren't currently subject to the tax.

In addition, the measure would dedicate the revenue from the tax, which was created by the Affordable Care Act, to Medicare's hospital insurance trust fund.

Also, the proposal would build on the Inflation Reduction Act, which congressional Democrats passed last summer, by allowing Medicare to negotiate the prices of more drugs and bringing drugs into negotiation sooner after they launch. And it would extend the law's requirement that drug companies pay rebates to Medicare if they increase prices faster than inflation to commercial health insurance.

AP file

Improve Medicare's finances: Biden wants to shore up Medicare's hospital insurance trust fund, known as Part A, by raising taxes on those earning more than $400,000 a year and by allowing Medicare to negotiate prices for even more drugs.

Medicare, which covers more than 65 million senior citizens and people with disabilities, will only be able to fully pay scheduled benefits until 2028, according to the most recent forecast by its trustees. Biden's proposal would extend Medicare's solvency by 25 years or more, according to the White House.

The plan would increase the net investment income tax rate on earned and unearned income above $400,000 to 5%, up from 3.8%. Also, it would be levied on the owners of certain pass-through firms who include business income on their personal tax returns and aren't currently subject to the tax.

In addition, the measure would dedicate the revenue from the tax, which was created by the Affordable Care Act, to Medicare's hospital insurance trust fund.

Also, the proposal would build on the Inflation Reduction Act, which congressional Democrats passed last summer, by allowing Medicare to negotiate the prices of more drugs and bringing drugs into negotiation sooner after they launch. And it would extend the law's requirement that drug companies pay rebates to Medicare if they increase prices faster than inflation to commercial health insurance.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

$35 insulin for all Americans: The budget also calls for capping the price of insulin at $35 a month for everyone. The Inflation Reduction Act limited the price of each insulin prescription to $35 a month for Medicare beneficiaries as of this year.

Democrats had hoped to extend the provision to those with private insurance as part of last year's package, but congressional Republicans blocked the measure.

AP file

$35 insulin for all Americans: The budget also calls for capping the price of insulin at $35 a month for everyone. The Inflation Reduction Act limited the price of each insulin prescription to $35 a month for Medicare beneficiaries as of this year.

Democrats had hoped to extend the provision to those with private insurance as part of last year's package, but congressional Republicans blocked the measure.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Reduce prescription drug costs for seniors: The budget proposes to limit Medicare beneficiaries' out-of-pocket costs for generic drugs used for certain chronic conditions to no more than $2. Seniors' costs would also drop if Medicare expanded its drug price negotiations.

AP file

Reduce prescription drug costs for seniors: The budget proposes to limit Medicare beneficiaries' out-of-pocket costs for generic drugs used for certain chronic conditions to no more than $2. Seniors' costs would also drop if Medicare expanded its drug price negotiations.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Make enhanced Obamacare subsidies permanent: Biden wants to continue the more generous Affordable Care Act subsidies, which are set to expire after 2025. The temporary enhancement has beefed up the premium subsidy and allowed more middle-class folks to qualify. The proposal would also provide Medicaid-like coverage to those in states that have not expanded the public health insurance program for low-income Americans.

AP file

Make enhanced Obamacare subsidies permanent: Biden wants to continue the more generous Affordable Care Act subsidies, which are set to expire after 2025. The temporary enhancement has beefed up the premium subsidy and allowed more middle-class folks to qualify. The proposal would also provide Medicaid-like coverage to those in states that have not expanded the public health insurance program for low-income Americans.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Increase food security: The budget would provide more than $15 billion to allow more states and schools to provide free school meals to an additional 9 million children.

AP file

Increase food security: The budget would provide more than $15 billion to allow more states and schools to provide free school meals to an additional 9 million children.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Reduce maternal mortality: Biden would provide $471 million to reduce maternal mortality rates and expand maternal health initiatives in rural communities. It would also require all states to provide continuous Medicaid postpartum coverage for 12 months, instead of 60 days.

AP file

Reduce maternal mortality: Biden would provide $471 million to reduce maternal mortality rates and expand maternal health initiatives in rural communities. It would also require all states to provide continuous Medicaid postpartum coverage for 12 months, instead of 60 days.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Lower Medicaid spending: The budget would require private insurance companies that provide Medicaid coverage to pay back some money when they charge the program far more than they actually spend on patient care. And it would give the Department of Health and Human Services the authority to negotiate additional, supplemental Medicaid drug rebates on behalf of states.

AP file

Lower Medicaid spending: The budget would require private insurance companies that provide Medicaid coverage to pay back some money when they charge the program far more than they actually spend on patient care. And it would give the Department of Health and Human Services the authority to negotiate additional, supplemental Medicaid drug rebates on behalf of states.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Make college more affordable: The spending plan calls for a $500 increase to the maximum Pell grant, which is awarded to roughly 7 million college students from the lowest-income families annually. Currently, the maximum Pell grant is $7,395 for the 2023-2024 school year. Congress has increased the maximum amount by $900 over the past two years, but the grant historically covered a larger share of the cost of college than it does now.

Biden's budget would also provide $500 million for a new grant program to help make two years of community college free.

AP file

Make college more affordable: The spending plan calls for a $500 increase to the maximum Pell grant, which is awarded to roughly 7 million college students from the lowest-income families annually. Currently, the maximum Pell grant is $7,395 for the 2023-2024 school year. Congress has increased the maximum amount by $900 over the past two years, but the grant historically covered a larger share of the cost of college than it does now.

Biden's budget would also provide $500 million for a new grant program to help make two years of community college free.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Universal preschool and affordable child care: The budget would provide funding for a new federal-state partnership program that would provide universal, free preschool. The spending plan would also increase funding for existing federal early care and education programs.

AP file

Universal preschool and affordable child care: The budget would provide funding for a new federal-state partnership program that would provide universal, free preschool. The spending plan would also increase funding for existing federal early care and education programs.

-

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Provide paid family and medical leave: Biden's budget would establish a national paid family and medical leave program. It would provide 12 weeks of leave for eligible employees to take time off to care for and bond with a new child, care for a seriously ill loved one, heal from their own serious illness, address circumstances arising from a loved one's military deployment, or find safety from domestic violence, sexual assault or stalking, according to the administration.

Congress provided for some paid sick leave during the Covid-19 pandemic, but lawmakers let the benefit expire in 2021.

AP file

Provide paid family and medical leave: Biden's budget would establish a national paid family and medical leave program. It would provide 12 weeks of leave for eligible employees to take time off to care for and bond with a new child, care for a seriously ill loved one, heal from their own serious illness, address circumstances arising from a loved one's military deployment, or find safety from domestic violence, sexual assault or stalking, according to the administration.

Congress provided for some paid sick leave during the Covid-19 pandemic, but lawmakers let the benefit expire in 2021.

-

Biden’s appeals court nominee faces rare Democratic scrutiny

AP file

Address climate change: The spending plan calls for billions of dollars of investment to help address climate change.

For example, money would go toward creating clean-energy jobs and cutting energy bills for families, funding climate research and helping communities become strengthen their infrastructure to withstand floods, wildfires, storms and drought brought on by climate change.

The investments would also help achieve Biden's goal to cut greenhouse gas emissions by 50%-52% by 2030.

AP file

Address climate change: The spending plan calls for billions of dollars of investment to help address climate change.

For example, money would go toward creating clean-energy jobs and cutting energy bills for families, funding climate research and helping communities become strengthen their infrastructure to withstand floods, wildfires, storms and drought brought on by climate change.

The investments would also help achieve Biden's goal to cut greenhouse gas emissions by 50%-52% by 2030.