The economic environment for starting a small business is significantly less hospitable than it was a year ago, according to new data from NerdWallet’s Small-Business Opportunity Index, and the increasingly unfavorable conditions have some small-business experts advising would-be entrepreneurs to prepare for rougher-than-usual starts — or even to put their business plans on hold.

The NerdWallet Small-Business Opportunity Index evaluates six types of economic data that reflect the feasibility of and common hurdles associated with starting a business: average rates on short-maturity loans borrowed for business purposes; difficulty finding qualified employees; SBA loan approvals for people of color, women, veterans and rural businesses; office rent costs; general economic conditions; and regulatory concerns among small businesses.

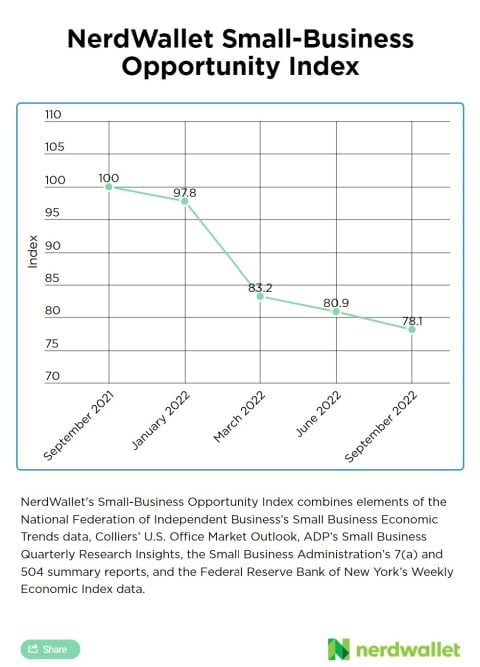

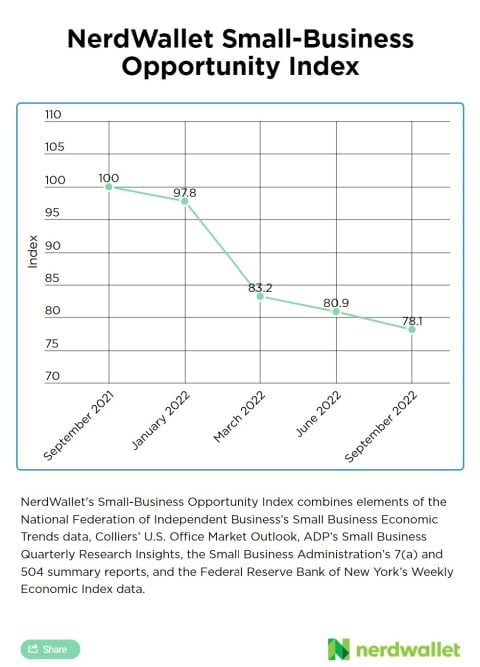

Overall, the NerdWallet Small-Business Opportunity Index has steadily declined from its base of 100 in September 2021 to 78.1 in September 2022, reflecting a weakening environment for starting small businesses.

Interest rates, labor issues, other factors pushing index down

According to the index’s underlying data, the proportions of SBA 7(a) loan approvals going to people of color, women and veterans have increased since September 2021. In addition, data from the National Federation of Independent Business shows lessening degrees of relative concern among small-business owners about government regulation.

But other data from the National Federation of Independent Business, Colliers International Group and the Federal Reserve Bank of New York highlight significantly higher interest rates, increasing difficulty finding qualified employees, upticks in rent costs and overall economic headwinds, all of which pushed the index down over the last 12 months.

It’s indeed a challenging time for people thinking about starting small businesses, says Rob Cordasco, a Savannah, Georgia-based certified public accountant who specializes in entrepreneurs. “Setting one up is easy,” he says. “Surviving? Different story.”

Getty Images

An increasingly inhospitable economic environment means that starting a small business now will feel a lot different than it would have six months or a year ago, according to small-business pros.

Experts say: Aspiring entrepreneurs should do 5 things differently now

An increasingly inhospitable economic environment means that starting a small business now will feel a lot different than it would have six months or a year ago, according to three small-business pros. They say entrepreneurs who want to launch now need to take a different approach to some typical startup rules.

1. Be more strategic about inventory

People starting small businesses now have to put extra thought toward the timing of their inventory purchases. Prices later may be much higher than prices today. “If you purchase it now, how much will you save when inflation hits?” asks Desha Elliott, a business advisor at Accion Opportunity Fund.

Starting a new business now also means doing more than the usual amount of supply chain planning. Focus on buying inventory that’s currently available, and try to work with three or four vendors that carry a product you need so you maximize your access, says Julie Brander, a certified business mentor and district director for SCORE Alabama.

2. Keep a bigger cash cushion and prepare for different scenarios

“Absolutely have a reserve,” Brander says. The standard advice of one to three months’ worth of cash reserves is now three to six months, she notes.

Also, think through how you’re going to handle disappointing sales or a full-on recession. “What is that procedure that you have in place to help when your customer flow slows down and you need cash flow?” Elliott says. “Are there costs that maybe you can restructure? … You want to ask before any situation happens.”

3. Invest in workplace culture sooner

Tight labor markets mean new entrepreneurs may now have to put more time and effort into creating satisfying workplaces for employees during the early stages of building their businesses, according to Elliott. “You want to keep your employees engaged and committed during the shortages. And so what are you doing to cultivate that company culture and really show that appreciation?” she says.

4. Consider pumping the brakes …

Most people thinking about starting businesses should probably wait until conditions improve, Cordasco says. “Maybe not jump in with both feet, maybe you kind of just ease your way into it,” he says. “I wouldn’t be overly optimistic.”

Entrepreneurs who do get started now may need to take extra precautions for some things to go sideways, he adds. Acquiring labor and supplies, for example, used to be a matter of having enough money; now, he says, “Those things are really hard to come by, regardless of how much money you have.”

5. … Or not

The sidelines may be the right place for some would-be entrepreneurs right now. But for others, now could actually be a good time to start a business, Brander says. “Look around and determine what’s needed in the community. Business is a solution to people’s problems,” she notes.

“Even though times are volatile and expenses and interest rates are at an all-time high, there are still plenty of opportunities for regular entrepreneurs to start their businesses,” Elliott adds. Entrepreneurs who lay solid foundations now may be primed for success when conditions improve, she notes. “Entrepreneurship is a marathon and not a sprint.”

METHODOLOGY

NerdWallet’s Small-Business Opportunity Index combines elements of the National Federation of Independent Business’s Small Business Economic Trends data, Colliers’ U.S. Office Market Outlook, ADP’s Small Business Quarterly Research Insights, the Small Business Administration’s 7(a) and 504 summary reports, and the Federal Reserve Bank of New York’s Weekly Economic Index data.

___

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: hedgehog94 / Shutterstock

Small businesses are the heart of the U.S. economy. Small businesses represent 99.9% of all businesses in the U.S., collectively employing nearly half of all U.S. employees and generating nearly half of U.S. annual GDP, according to data from the U.S. Small Business Administration.

But the past two years have been treacherous for many small businesses. The initial shock of the COVID-19 pandemic disrupted many businesses, leading 43% to close at least temporarily and producing 9.1 million job losses in the first two quarters of 2020. Government support like the Paycheck Protection Program allowed businesses to weather the crisis, but challenges remain. Labor market tightness over the last year has made it difficult to recruit and retain talent and driven wages upward. Supply chain issues and inflation have made it harder to obtain materials and manage costs. And with interest rates on the rise and investors becoming more cautious amid fears of a recession, capital to start or grow a business is likely to be harder to come by in the months and years ahead.

While recent conditions have been uniquely challenging for small business, the role of small business in the economy has been on a decline for several decades. In the late 1980s, small businesses—defined here as those employing between one and 499 workers—employed 54.5% of working Americans and were responsible for 48.6% of payrolls. Today those figures are 46.4% and 39.4%, even though the overall percentage of firms defined as a small business has held steady over the same span.

Shutterstock

Photo Credit: hedgehog94 / Shutterstock

Small businesses are the heart of the U.S. economy. Small businesses represent 99.9% of all businesses in the U.S., collectively employing nearly half of all U.S. employees and generating nearly half of U.S. annual GDP, according to data from the U.S. Small Business Administration.

But the past two years have been treacherous for many small businesses. The initial shock of the COVID-19 pandemic disrupted many businesses, leading 43% to close at least temporarily and producing 9.1 million job losses in the first two quarters of 2020. Government support like the Paycheck Protection Program allowed businesses to weather the crisis, but challenges remain. Labor market tightness over the last year has made it difficult to recruit and retain talent and driven wages upward. Supply chain issues and inflation have made it harder to obtain materials and manage costs. And with interest rates on the rise and investors becoming more cautious amid fears of a recession, capital to start or grow a business is likely to be harder to come by in the months and years ahead.

While recent conditions have been uniquely challenging for small business, the role of small business in the economy has been on a decline for several decades. In the late 1980s, small businesses—defined here as those employing between one and 499 workers—employed 54.5% of working Americans and were responsible for 48.6% of payrolls. Today those figures are 46.4% and 39.4%, even though the overall percentage of firms defined as a small business has held steady over the same span.

-

Starting a business has gotten harder this year, data suggests

One reason for this decline is the growing concentration of larger firms over time. With the market power to crowd out smaller competitors and more resources to invest, large firms have grown both their position with consumers and their strength in labor markets.

However, the presence of small businesses and large firms varies by industry. Highly concentrated industries like finance and insurance and utilities have lower percentages of employees and payrolls at small businesses. In contrast, businesses in agriculture and construction each have more than 80% of employees and 75% of payrolls at small businesses.

One reason for this decline is the growing concentration of larger firms over time. With the market power to crowd out smaller competitors and more resources to invest, large firms have grown both their position with consumers and their strength in labor markets.

However, the presence of small businesses and large firms varies by industry. Highly concentrated industries like finance and insurance and utilities have lower percentages of employees and payrolls at small businesses. In contrast, businesses in agriculture and construction each have more than 80% of employees and 75% of payrolls at small businesses.

-

-

Starting a business has gotten harder this year, data suggests

Small businesses’ role in the economy can also vary by location. Perhaps unsurprisingly, most of the states with the highest dependence on small businesses for employment are among the least populous. The leading states are rural, sparsely populated locations in the central U.S., like Montana, Wyoming, and South Dakota, and in New England, like Vermont and Maine.

Small businesses’ role in the economy can also vary by location. Perhaps unsurprisingly, most of the states with the highest dependence on small businesses for employment are among the least populous. The leading states are rural, sparsely populated locations in the central U.S., like Montana, Wyoming, and South Dakota, and in New England, like Vermont and Maine.

-

Starting a business has gotten harder this year, data suggests

At the metro level, other factors could explain a city’s dependence on small business. Some top cities, like Austin and San Francisco, have strong startup ecosystems that encourage small business development. Others are Rust Belt locations like Buffalo and Grand Rapids, where major industrial presences of old have ceased or reduced operations and left more room for small businesses to flourish. And some leaders, including Los Angeles and Miami, have high populations of racial or ethnic minorities and immigrants, two groups that are more likely to start small businesses.

The data used in this analysis is from the U.S. Census Bureau’s Statistics of U.S. Businesses Tables. To determine the locations most dependent on small businesses, researchers at Smartest Dollar calculated a composite score based on the percentage of employees at small businesses, the percentage of total payroll at small businesses, and the number of small businesses per 10,000 people. In the event of a tie, the location with the greater percentage of employees at small businesses was ranked higher.

Here are the U.S. metropolitan areas most dependent on small business.

At the metro level, other factors could explain a city’s dependence on small business. Some top cities, like Austin and San Francisco, have strong startup ecosystems that encourage small business development. Others are Rust Belt locations like Buffalo and Grand Rapids, where major industrial presences of old have ceased or reduced operations and left more room for small businesses to flourish. And some leaders, including Los Angeles and Miami, have high populations of racial or ethnic minorities and immigrants, two groups that are more likely to start small businesses.

The data used in this analysis is from the U.S. Census Bureau’s Statistics of U.S. Businesses Tables. To determine the locations most dependent on small businesses, researchers at Smartest Dollar calculated a composite score based on the percentage of employees at small businesses, the percentage of total payroll at small businesses, and the number of small businesses per 10,000 people. In the event of a tie, the location with the greater percentage of employees at small businesses was ranked higher.

Here are the U.S. metropolitan areas most dependent on small business.

-

-

Starting a business has gotten harder this year, data suggests

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: ShengYing Lin / Shutterstock

- Composite score: 48.87

- Percentage of employees at small businesses: 48.4%

- Percentage of total payroll at small businesses: 40.6%

- Small businesses per 10k people: 189.7

- Total number of small businesses with employees: 43,551

- Total employees at small businesses: 434,122

- Total annual payroll at small businesses: $22,136,221,000

Shutterstock

Photo Credit: ShengYing Lin / Shutterstock

- Composite score: 48.87

- Percentage of employees at small businesses: 48.4%

- Percentage of total payroll at small businesses: 40.6%

- Small businesses per 10k people: 189.7

- Total number of small businesses with employees: 43,551

- Total employees at small businesses: 434,122

- Total annual payroll at small businesses: $22,136,221,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Pete Niesen / Shutterstock

- Composite score: 51.03

- Percentage of employees at small businesses: 49.7%

- Percentage of total payroll at small businesses: 36.5%

- Small businesses per 10k people: 227.8

- Total number of small businesses with employees: 106,989

- Total employees at small businesses: 1,134,646

- Total annual payroll at small businesses: $83,169,809,000

Shutterstock

Photo Credit: Pete Niesen / Shutterstock

- Composite score: 51.03

- Percentage of employees at small businesses: 49.7%

- Percentage of total payroll at small businesses: 36.5%

- Small businesses per 10k people: 227.8

- Total number of small businesses with employees: 106,989

- Total employees at small businesses: 1,134,646

- Total annual payroll at small businesses: $83,169,809,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: ESB Professional / Shutterstock

- Composite score: 53.97

- Percentage of employees at small businesses: 48.5%

- Percentage of total payroll at small businesses: 43.1%

- Small businesses per 10k people: 187.2

- Total number of small businesses with employees: 52,418

- Total employees at small businesses: 584,058

- Total annual payroll at small businesses: $30,463,291,000

Shutterstock

Photo Credit: ESB Professional / Shutterstock

- Composite score: 53.97

- Percentage of employees at small businesses: 48.5%

- Percentage of total payroll at small businesses: 43.1%

- Small businesses per 10k people: 187.2

- Total number of small businesses with employees: 52,418

- Total employees at small businesses: 584,058

- Total annual payroll at small businesses: $30,463,291,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Matt Gush / Shutterstock

- Composite score: 54.03

- Percentage of employees at small businesses: 52.7%

- Percentage of total payroll at small businesses: 51.7%

- Small businesses per 10k people: 136.0

- Total number of small businesses with employees: 13,615

- Total employees at small businesses: 146,318

- Total annual payroll at small businesses: $6,478,226,000

Shutterstock

Photo Credit: Matt Gush / Shutterstock

- Composite score: 54.03

- Percentage of employees at small businesses: 52.7%

- Percentage of total payroll at small businesses: 51.7%

- Small businesses per 10k people: 136.0

- Total number of small businesses with employees: 13,615

- Total employees at small businesses: 146,318

- Total annual payroll at small businesses: $6,478,226,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Andrei Medvedev / Shutterstock

- Composite score: 57.70

- Percentage of employees at small businesses: 49.2%

- Percentage of total payroll at small businesses: 44.2%

- Small businesses per 10k people: 187.6

- Total number of small businesses with employees: 118,633

- Total employees at small businesses: 1,359,594

- Total annual payroll at small businesses: $86,002,592,000

Shutterstock

Photo Credit: Andrei Medvedev / Shutterstock

- Composite score: 57.70

- Percentage of employees at small businesses: 49.2%

- Percentage of total payroll at small businesses: 44.2%

- Small businesses per 10k people: 187.6

- Total number of small businesses with employees: 118,633

- Total employees at small businesses: 1,359,594

- Total annual payroll at small businesses: $86,002,592,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Sergey Novikov / Shutterstock

- Composite score: 58.17

- Percentage of employees at small businesses: 49.2%

- Percentage of total payroll at small businesses: 44.5%

- Small businesses per 10k people: 187.1

- Total number of small businesses with employees: 21,061

- Total employees at small businesses: 241,452

- Total annual payroll at small businesses: $10,254,061,000

Shutterstock

Photo Credit: Sergey Novikov / Shutterstock

- Composite score: 58.17

- Percentage of employees at small businesses: 49.2%

- Percentage of total payroll at small businesses: 44.5%

- Small businesses per 10k people: 187.1

- Total number of small businesses with employees: 21,061

- Total employees at small businesses: 241,452

- Total annual payroll at small businesses: $10,254,061,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: kan khampanya / Shutterstock

- Composite score: 59.87

- Percentage of employees at small businesses: 49.6%

- Percentage of total payroll at small businesses: 42.2%

- Small businesses per 10k people: 215.0

- Total number of small businesses with employees: 71,641

- Total employees at small businesses: 652,088

- Total annual payroll at small businesses: $34,234,372,000

Shutterstock

Photo Credit: kan khampanya / Shutterstock

- Composite score: 59.87

- Percentage of employees at small businesses: 49.6%

- Percentage of total payroll at small businesses: 42.2%

- Small businesses per 10k people: 215.0

- Total number of small businesses with employees: 71,641

- Total employees at small businesses: 652,088

- Total annual payroll at small businesses: $34,234,372,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Victor Moussa / Shutterstock

- Composite score: 60.27

- Percentage of employees at small businesses: 50.9%

- Percentage of total payroll at small businesses: 39.8%

- Small businesses per 10k people: 262.4

- Total number of small businesses with employees: 501,830

- Total employees at small businesses: 4,417,456

- Total annual payroll at small businesses: $257,566,762,000

Shutterstock

Photo Credit: Victor Moussa / Shutterstock

- Composite score: 60.27

- Percentage of employees at small businesses: 50.9%

- Percentage of total payroll at small businesses: 39.8%

- Small businesses per 10k people: 262.4

- Total number of small businesses with employees: 501,830

- Total employees at small businesses: 4,417,456

- Total annual payroll at small businesses: $257,566,762,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Henryk Sadura / Shutterstock

- Composite score: 60.37

- Percentage of employees at small businesses: 50.2%

- Percentage of total payroll at small businesses: 47.9%

- Small businesses per 10k people: 179.5

- Total number of small businesses with employees: 19,411

- Total employees at small businesses: 257,668

- Total annual payroll at small businesses: $11,888,215,000

Shutterstock

Photo Credit: Henryk Sadura / Shutterstock

- Composite score: 60.37

- Percentage of employees at small businesses: 50.2%

- Percentage of total payroll at small businesses: 47.9%

- Small businesses per 10k people: 179.5

- Total number of small businesses with employees: 19,411

- Total employees at small businesses: 257,668

- Total annual payroll at small businesses: $11,888,215,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Jon Bilous / Shutterstock

- Composite score: 61.03

- Percentage of employees at small businesses: 51.0%

- Percentage of total payroll at small businesses: 41.2%

- Small businesses per 10k people: 226.7

- Total number of small businesses with employees: 56,914

- Total employees at small businesses: 552,890

- Total annual payroll at small businesses: $26,756,996,000

Shutterstock

Photo Credit: Jon Bilous / Shutterstock

- Composite score: 61.03

- Percentage of employees at small businesses: 51.0%

- Percentage of total payroll at small businesses: 41.2%

- Small businesses per 10k people: 226.7

- Total number of small businesses with employees: 56,914

- Total employees at small businesses: 552,890

- Total annual payroll at small businesses: $26,756,996,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Richard Cavalleri / Shutterstock

- Composite score: 69.37

- Percentage of employees at small businesses: 51.7%

- Percentage of total payroll at small businesses: 47.2%

- Small businesses per 10k people: 205.9

- Total number of small businesses with employees: 33,432

- Total employees at small businesses: 332,357

- Total annual payroll at small businesses: $15,216,318,000

Shutterstock

Photo Credit: Richard Cavalleri / Shutterstock

- Composite score: 69.37

- Percentage of employees at small businesses: 51.7%

- Percentage of total payroll at small businesses: 47.2%

- Small businesses per 10k people: 205.9

- Total number of small businesses with employees: 33,432

- Total employees at small businesses: 332,357

- Total annual payroll at small businesses: $15,216,318,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Sean Pavone / Shutterstock

- Composite score: 71.17

- Percentage of employees at small businesses: 53.7%

- Percentage of total payroll at small businesses: 48.9%

- Small businesses per 10k people: 189.4

- Total number of small businesses with employees: 24,092

- Total employees at small businesses: 269,529

- Total annual payroll at small businesses: $12,389,281,000

Shutterstock

Photo Credit: Sean Pavone / Shutterstock

- Composite score: 71.17

- Percentage of employees at small businesses: 53.7%

- Percentage of total payroll at small businesses: 48.9%

- Small businesses per 10k people: 189.4

- Total number of small businesses with employees: 24,092

- Total employees at small businesses: 269,529

- Total annual payroll at small businesses: $12,389,281,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Natalia Bratslavsky / Shutterstock

- Composite score: 72.07

- Percentage of employees at small businesses: 53.2%

- Percentage of total payroll at small businesses: 47.9%

- Small businesses per 10k people: 199.3

- Total number of small businesses with employees: 28,402

- Total employees at small businesses: 277,578

- Total annual payroll at small businesses: $11,683,681,000

Shutterstock

Photo Credit: Natalia Bratslavsky / Shutterstock

- Composite score: 72.07

- Percentage of employees at small businesses: 53.2%

- Percentage of total payroll at small businesses: 47.9%

- Small businesses per 10k people: 199.3

- Total number of small businesses with employees: 28,402

- Total employees at small businesses: 277,578

- Total annual payroll at small businesses: $11,683,681,000

-

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: Chones / Shutterstock

- Composite score: 72.50

- Percentage of employees at small businesses: 51.8%

- Percentage of total payroll at small businesses: 45.9%

- Small businesses per 10k people: 249.5

- Total number of small businesses with employees: 327,093

- Total employees at small businesses: 2,818,026

- Total annual payroll at small businesses: $157,195,952,000

Shutterstock

Photo Credit: Chones / Shutterstock

- Composite score: 72.50

- Percentage of employees at small businesses: 51.8%

- Percentage of total payroll at small businesses: 45.9%

- Small businesses per 10k people: 249.5

- Total number of small businesses with employees: 327,093

- Total employees at small businesses: 2,818,026

- Total annual payroll at small businesses: $157,195,952,000

-

Starting a business has gotten harder this year, data suggests

Shutterstock

Photo Credit: May Lana / Shutterstock

- Composite score: 78.17

- Percentage of employees at small businesses: 53.1%

- Percentage of total payroll at small businesses: 47.6%

- Small businesses per 10k people: 278.9

- Total number of small businesses with employees: 172,172

- Total employees at small businesses: 1,209,509

- Total annual payroll at small businesses: $56,113,986,000

Shutterstock

Photo Credit: May Lana / Shutterstock

- Composite score: 78.17

- Percentage of employees at small businesses: 53.1%

- Percentage of total payroll at small businesses: 47.6%

- Small businesses per 10k people: 278.9

- Total number of small businesses with employees: 172,172

- Total employees at small businesses: 1,209,509

- Total annual payroll at small businesses: $56,113,986,000