NEW YORK — Apple is getting into the buy now, pay later space with a few tweaks to the existing model — including no option to pay with a credit card. The company will roll out the product to some consumers this spring, and will begin reporting the loans to credit bureaus in the fall.

Since the start of the pandemic, the option to “buy now, pay later” has skyrocketed in popularity, especially among young and low-income consumers who may not have ready access to traditional credit.

If you shop online for clothes or furniture, sneakers or concert tickets, you’ve seen the option at checkout to break the cost into smaller installments over time. Companies like Afterpay, Affirm, Klarna, and Paypal already offer the service, typically with late fees for missed payments and the option to use a credit card or bank account to make installment payments.

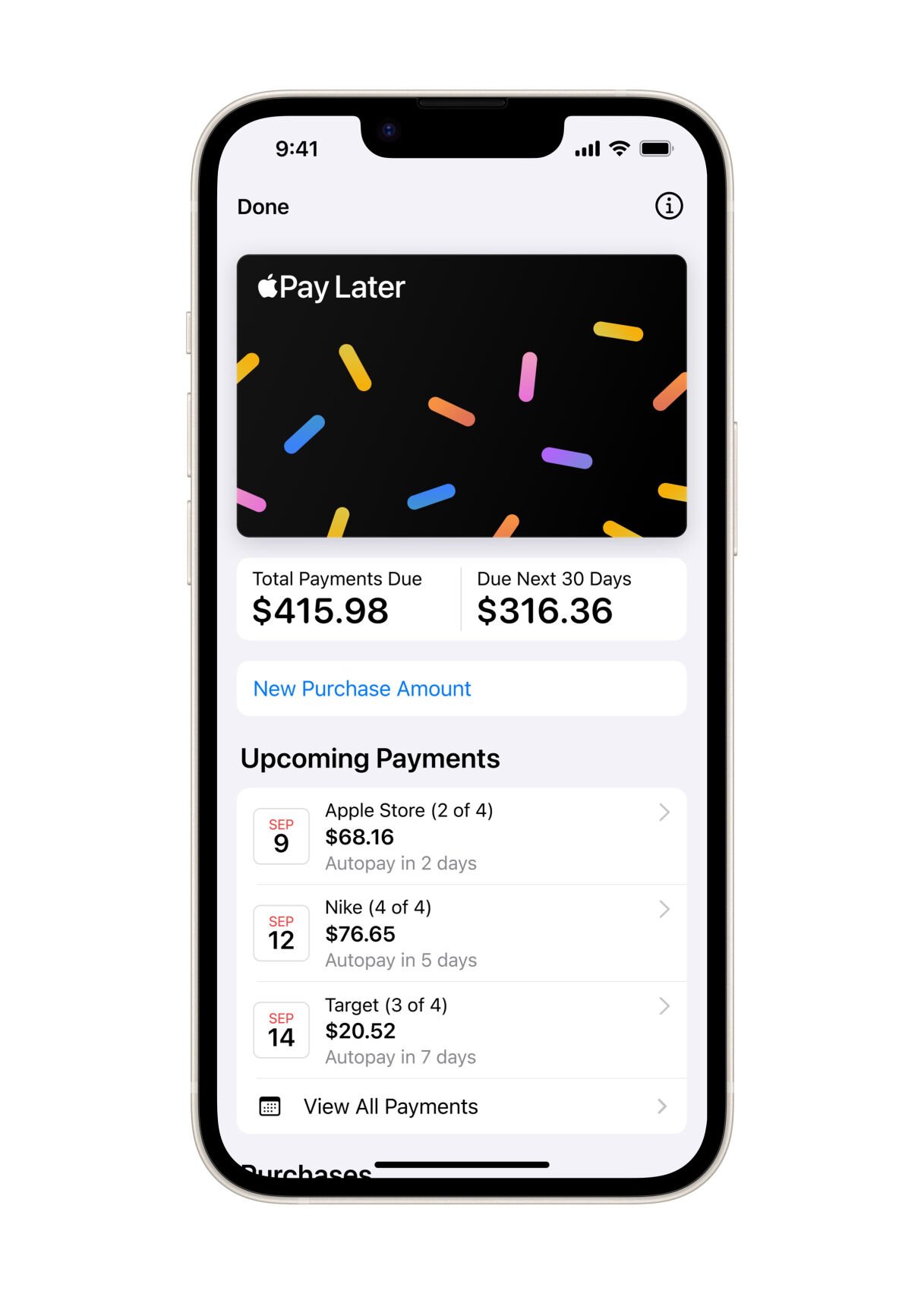

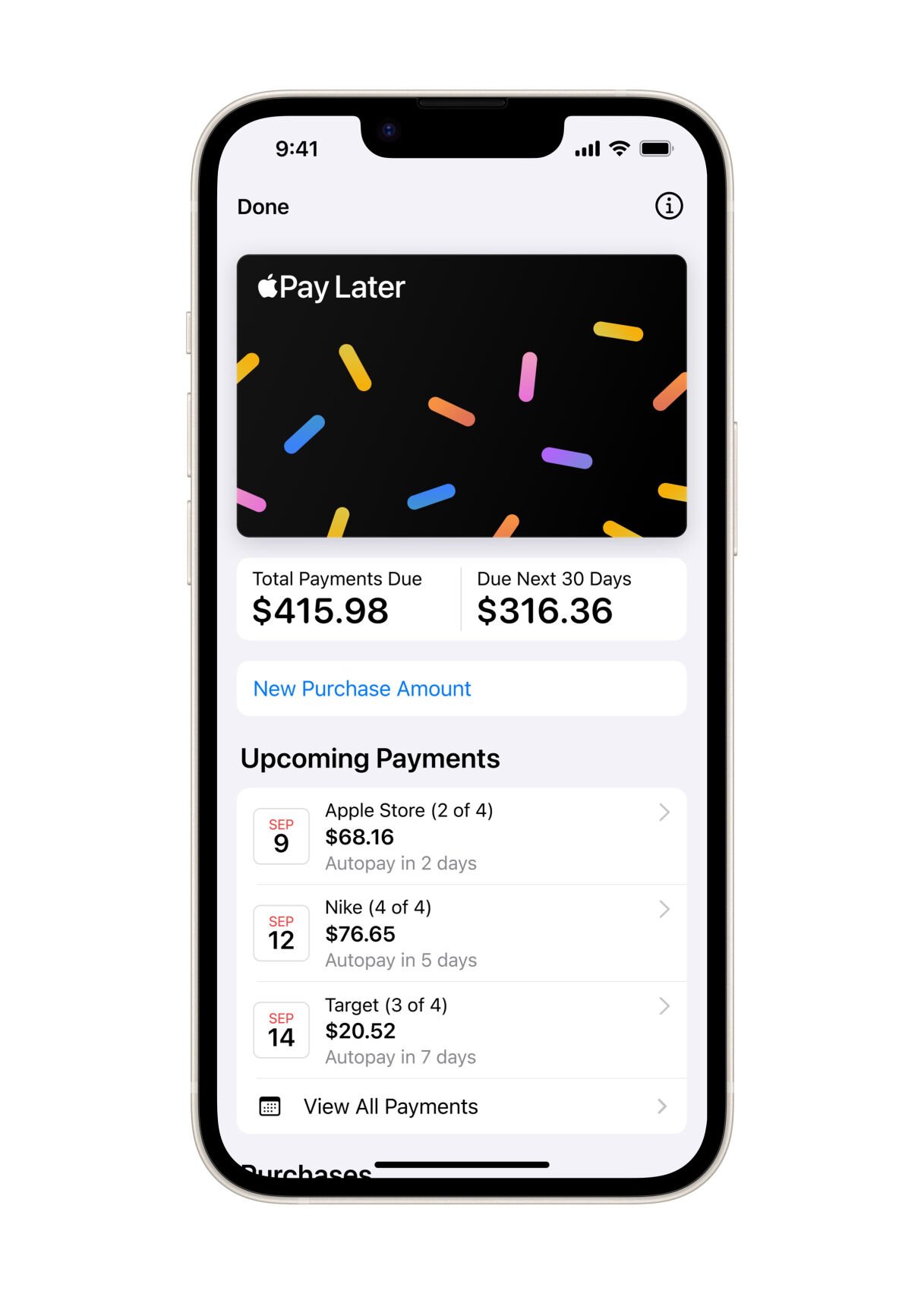

Apple’s version, which is integrated with Apple Pay and facilitated by MasterCard, will require the consumer to use a debit card and a bank account to make those payments, the company said, and will not charge flat or percentage late fees. Instead, missed payments will eventually result in the consumer losing access to these kinds of loans.

Here’s what you need to know:

HOW DOES BUY NOW, PAY LATER WORK?

Business Wire

Designed with users’ financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees.

Branded as “interest-free loans,” buy now, pay later services require you to download an app, link a bank account or debit or credit card, and sign up to pay in weekly or monthly installments. Some companies, such as Klarna and Afterpay, do soft credit checks, which aren’t reported to credit bureaus, before approving borrowers. This is how Apple’s product will operate as well. Most users are approved in minutes. Scheduled payments are then automatically deducted from one’s bank account or charged to one’s card.

The services generally don’t charge more than a customer would have paid up front, meaning there’s technically no interest, so long as one makes the payments on time.

But if a customer pays late, they may be subject to a flat fee or a fee calculated as a percentage of the total owed. These can run as high as $34 plus interest. If a customer misses multiple payments, they may be shut out from using the service in the future, and the delinquency could hurt one’s credit score.

In Apple’s case, the company said there will be no late fees, either flat or as a percentage — only the possibility of missed payments reported to credit bureaus, and a loss of access to the loans. If a user wishes to defer payments, or set up a different payment plan, Apple said they can contact support. Several services allow users to defer payments in this way.

***

ARE MY PURCHASES PROTECTED?

In the U.S., buy now, pay later services are not currently covered by the Truth in Lending Act, which regulates credit cards and other types of loans (those paid back in more than four installments).

That means you could find it more difficult to settle disputes with merchants, return items, or get your money back in cases of fraud. Companies can offer protections, but they don’t have to. Apple’s protections are offered through Mastercard.

Lauren Saunders, associate director at the National Consumer Law Center, advises borrowers to avoid linking a credit card to buy now, pay later apps whenever possible. If you do, you lose the protections you get from using the credit card while also opening yourself up to owing interest to the card company.

“Use the credit card directly and get those protections,” she said. “Otherwise, it’s the worst of both worlds.”

Apple’s decision not to permit consumers to link a credit card to its buy now, pay later product means the consumer avoids stacking debt in this way.

***

WHAT ARE THE OTHER RISKS?

Because there’s no centralized reporting of buy now, pay later purchases, those debts won’t necessarily appear on your credit profile with major credit rating agencies.

That means more companies may let you buy more items, even if you can’t afford them, because the lenders don’t know how many loans you have set up with other companies.

Payments you make on time aren’t reported to credit rating agencies, but missed payments are.

“Right now, buy now, pay later can’t generally help you build credit, but it can hurt,” said Saunders.

Elyse Hicks, consumer policy counsel at Americans for Financial Reform, a progressive nonprofit, said people may not consider seriously enough whether they’ll still be able to afford payments down the road.

“Because of inflation, people may think, ‘I’m going to have to get what I need and pay for it later in these installments,’” she said. “But are you still going to be able to afford the things you’re affording now six months from now?”

***

WHY DO RETAILERS OFFER BUY NOW, PAY LATER?

Retailers accept the backend fees of buy now, pay later services because the products increase cart sizes. When shoppers are given the option to pay off purchases in installments, they’re more likely to buy more goods in one go.

When Apple announced it would be creating its own buy now, pay later service, Josiah Herndon, 23, joked on Twitter about “paying off 6 carts of (things) I can’t afford with Apple, Klarna, Afterpay, PayPal Pay in 4, Shop Pay in 4, & Affirm.”

Herndon, who works in insurance in Indianapolis, said he started using the services because it was taking a long time for him to be approved for a credit card, since his age meant he didn’t have an extensive credit history. He’s since used them to pay for high-end clothes, shoes, and other luxury goods. Herndon said he lines the payment schedules up with his paychecks so he doesn’t miss installments, and called the option “very convenient.”

***

WHO SHOULD USE BUY NOW, PAY LATER?

If you have the ability to make all payments on time, buy now, pay later loans are a relatively healthy, interest-free form of consumer credit.

“If (the loans) work as promised, and if people can avoid late fees and don’t have trouble managing their finances, they have a place,” said Saunders, of the National Consumer Law Center.

But if you’re looking to build your credit score, and you’re able to make payments on time, a credit card is a better choice, she said. The same goes if you want strong legal protections from fraud, and clear, centralized reporting of loans.

If you’re uncertain whether you’ll be able to make payments on time, consider whether the fees charged by buy now, pay later companies will exceed the penalties and interest a credit card company or other lender would charge.

***

HOW WILL ECONOMIC INSTABILITY AFFECT BUY NOW, PAY LATER?

As the cost of living increases, some shoppers have started breaking up payments on essentials, rather than just big-ticket items like electronics or designer clothes. A poll by Morning Consult last fall found 15% of buy now, pay later customers were using the service for routine purchases, such as groceries and gas, sounding alarm bells among financial advisors.

Hicks points to the rising number of delinquent payments as a sign that buy now, pay later could already be contributing to unmanageable debt for consumers. A July report from the Fitch ratings agency found delinquencies on the apps increased sharply in the 12 months that ended March 31 of last year, to as high as 4.1% for Afterpay, while credit card delinquencies held relatively steady at 1.4%.

“The increasing popularity of this is going to be interesting to see over these different economic waves,” Hicks said. “The immediate fallout is what’s happening now.”

-

Apple rolls out buy now, pay later service: What to know

Canva

The average FICO Score in the U.S. was 714 in 2022, according to Experian data. The data suggests that consumers, collectively, continued to effectively manage their credit despite economic shifts in 2022.

As one might expect from circumstantial evidence, it doesn't mean it was a quiet year for nearly any economic participant in 2022:

- Lingering shortages have caused prices to rise for consumer goods and services small and large—from quick-service restaurant purchases to vehicles and homes. And while some of those shortages have started to subside, others, such as housing in much of the nation, may continue to persist.

- In addition, recent interest rate hikes mean consumers are paying more to carry balances on their credit cards. As the Federal Reserve increases its federal funds target rate, the interest rate of variable-rate credit cards climbs in turn. (Changes to the Fed rate typically cause banks and credit card issuers to adjust their prime rate, which serves as a starting point for nearly all credit card APRs.)

- The unemployment rate remains near record lows, suggesting that while consumers may have had to cope with some price increases, they by and large still have the means to manage their mortgages, car loans and credit card balances.

In this analysis, we'll examine the effects economic forces have on Americans' credit scores.

Canva

The average FICO Score in the U.S. was 714 in 2022, according to Experian data. The data suggests that consumers, collectively, continued to effectively manage their credit despite economic shifts in 2022.

As one might expect from circumstantial evidence, it doesn't mean it was a quiet year for nearly any economic participant in 2022:

- Lingering shortages have caused prices to rise for consumer goods and services small and large—from quick-service restaurant purchases to vehicles and homes. And while some of those shortages have started to subside, others, such as housing in much of the nation, may continue to persist.

- In addition, recent interest rate hikes mean consumers are paying more to carry balances on their credit cards. As the Federal Reserve increases its federal funds target rate, the interest rate of variable-rate credit cards climbs in turn. (Changes to the Fed rate typically cause banks and credit card issuers to adjust their prime rate, which serves as a starting point for nearly all credit card APRs.)

- The unemployment rate remains near record lows, suggesting that while consumers may have had to cope with some price increases, they by and large still have the means to manage their mortgages, car loans and credit card balances.

In this analysis, we'll examine the effects economic forces have on Americans' credit scores.

-

Apple rolls out buy now, pay later service: What to know

Experian

The average FICO Score is unchanged from the September 2021 average of 714, but that stability belies the broad economic indicators over that time, which showed that markets and economic conditions were anything but steady through 2022. A credit score of 714 is generally considered good by lenders.

Average FICO score nearly unchanged among all generations

Taking a look at scores split out by generation, average credit scores changed little, if at all, for consumers both young and old. The larger cohorts—baby boomers, Generation X and millennials—each saw slight increases in their average FICO Score, while the less-populous Silent Generation and Generation Z saw no change in average credit scores in 2022.

Average FICO score by generation, 2022

- Silent Generation (77+): 760

- Baby boomers (58-76): 742

- Generation X (42-57): 706

- Millennials (26-41): 687

- Generation Z (18-25): 679

(Ages as of 2022)

Experian

The average FICO Score is unchanged from the September 2021 average of 714, but that stability belies the broad economic indicators over that time, which showed that markets and economic conditions were anything but steady through 2022. A credit score of 714 is generally considered good by lenders.

Average FICO score nearly unchanged among all generations

Taking a look at scores split out by generation, average credit scores changed little, if at all, for consumers both young and old. The larger cohorts—baby boomers, Generation X and millennials—each saw slight increases in their average FICO Score, while the less-populous Silent Generation and Generation Z saw no change in average credit scores in 2022.

Average FICO score by generation, 2022

- Silent Generation (77+): 760

- Baby boomers (58-76): 742

- Generation X (42-57): 706

- Millennials (26-41): 687

- Generation Z (18-25): 679

(Ages as of 2022)

-

-

Apple rolls out buy now, pay later service: What to know

Experian

FICO Scores in most states remained unchanged from 2021 despite economic headwinds faced by both producers and consumers throughout the year.

Among the few notable outliers were sparsely populated Alaska, which saw FICO Scores increase by six points in the past year, and South Carolina, which notched a three-point gain in average FICO Score.

Only five states, and the nation's capital, saw declines in 2022: Four states and Washington, D.C., saw average FICO Scores decline one point last year while Connecticut fell three points in 2022.

Experian

FICO Scores in most states remained unchanged from 2021 despite economic headwinds faced by both producers and consumers throughout the year.

Among the few notable outliers were sparsely populated Alaska, which saw FICO Scores increase by six points in the past year, and South Carolina, which notched a three-point gain in average FICO Score.

Only five states, and the nation's capital, saw declines in 2022: Four states and Washington, D.C., saw average FICO Scores decline one point last year while Connecticut fell three points in 2022.

-

Apple rolls out buy now, pay later service: What to know

Canva

Credit utilization, which measures how a consumer's credit card balances compare with their credit limits (typically expressed as a percentage), increased from 26% in September 2021 to 28% a year later. Inflation and higher interest rates are two factors that continue to drive up credit utilization rates, which has the potential to put downward pressure on FICO® Scores.

As one of the most impactful components of an individual's FICO Score, changes in a consumer's credit utilization ratio can cause their score to rise or fall. Generally, as an individual's credit utilization ratio decreases (or increases), scores improve (or decline). But economic forces can affect both the balances carried on credit cards and the credit limits these cardholders are granted by card issuers. Together, those two numbers comprise the credit utilization ratio.

Average overall credit utilization ratio

Credit card balances, as you'll see in more detail in Experian's 2022 Consumer Credit Review, have increased by 13.2% in the 12 months ending in September 2022, and inflation, as measured by the consumer price index, was 8.2% over that same period.

The sharp increase in average card balances can be attributed to three factors: overall inflation, which made nearly every purchase more costly for consumers; increased spending on goods and services that weren't always available for purchase in 2021; and higher APRs, which increased the interest accruing on existing credit card balances.

Similarly, card limits extended to consumers by lenders are also subject to economic conditions facing lenders. And while the average amount of total credit extended to consumers did increase throughout 2022, at 4.2% it was easily outstripped by the 13.2% card balance increase. Lenders are being more selective about extending credit, according to recent surveys of loan officers conducted by the Federal Reserve.

Canva

Credit utilization, which measures how a consumer's credit card balances compare with their credit limits (typically expressed as a percentage), increased from 26% in September 2021 to 28% a year later. Inflation and higher interest rates are two factors that continue to drive up credit utilization rates, which has the potential to put downward pressure on FICO® Scores.

As one of the most impactful components of an individual's FICO Score, changes in a consumer's credit utilization ratio can cause their score to rise or fall. Generally, as an individual's credit utilization ratio decreases (or increases), scores improve (or decline). But economic forces can affect both the balances carried on credit cards and the credit limits these cardholders are granted by card issuers. Together, those two numbers comprise the credit utilization ratio.

Average overall credit utilization ratio

Credit card balances, as you'll see in more detail in Experian's 2022 Consumer Credit Review, have increased by 13.2% in the 12 months ending in September 2022, and inflation, as measured by the consumer price index, was 8.2% over that same period.

The sharp increase in average card balances can be attributed to three factors: overall inflation, which made nearly every purchase more costly for consumers; increased spending on goods and services that weren't always available for purchase in 2021; and higher APRs, which increased the interest accruing on existing credit card balances.

Similarly, card limits extended to consumers by lenders are also subject to economic conditions facing lenders. And while the average amount of total credit extended to consumers did increase throughout 2022, at 4.2% it was easily outstripped by the 13.2% card balance increase. Lenders are being more selective about extending credit, according to recent surveys of loan officers conducted by the Federal Reserve.

-

-

Apple rolls out buy now, pay later service: What to know

Canva

The percentage of delinquent credit card accounts increased to 2.07% in September 2022, up from the prior year's near-record low of 1.23% delinquency rate. This increase brings delinquency rates back to pre-pandemic levels.

Percent of credit card accounts considered delinquent

- 2019: 2.04%

- 2020: 1.24%

- 2021: 1.23%

- 2022: 2.07%

While very little in the economy can be considered normal so far this decade, the resulting U-shaped curve does at least indicate we're exiting the pandemic economy, which slowed card purchases and swelled many bank accounts in 2020 and 2021. So while the increase from 2021 has been significant, delinquency rates remain consistent with the pre-pandemic average.

Canva

The percentage of delinquent credit card accounts increased to 2.07% in September 2022, up from the prior year's near-record low of 1.23% delinquency rate. This increase brings delinquency rates back to pre-pandemic levels.

Percent of credit card accounts considered delinquent

- 2019: 2.04%

- 2020: 1.24%

- 2021: 1.23%

- 2022: 2.07%

While very little in the economy can be considered normal so far this decade, the resulting U-shaped curve does at least indicate we're exiting the pandemic economy, which slowed card purchases and swelled many bank accounts in 2020 and 2021. So while the increase from 2021 has been significant, delinquency rates remain consistent with the pre-pandemic average.

-

Apple rolls out buy now, pay later service: What to know

Canva

Improving your FICO Score can be helpful before applying for a new line of credit such as a credit card, mortgage or personal loan. A higher score can help you secure better terms and lower interest rates available. Here are some actions that can help improve your credit score.

Pay all of your bills on time. This will help ensure your payment history remains unblemished and shows lenders that you have a history of managing credit responsibly. If you have any past due accounts, bringing them current as soon as possible can help your scores begin to recover.

Pay down credit card balances. Keeping balances on your credit cards low will help keep your credit utilization ratio at a good level.

Apply for credit only when you really need it. A credit application will typically result in a hard inquiry being added to your credit report. This can have a short-lived negative effect on your credit score. While the impact of one inquiry is typically minimal, the effect of multiple inquiries can compound if you submit frequent credit applications. Taking on a lot of new credit also reduces your average age of credit accounts, which can impact your score.

Understanding your credit profile can help you understand what lenders see when they look at your credit report. Getting your free credit score and credit report can show you where you are and what steps you may be able to take to improve your score.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story originally appeared on Experian and has been independently reviewed to meet journalistic standards.

Canva

Improving your FICO Score can be helpful before applying for a new line of credit such as a credit card, mortgage or personal loan. A higher score can help you secure better terms and lower interest rates available. Here are some actions that can help improve your credit score.

Pay all of your bills on time. This will help ensure your payment history remains unblemished and shows lenders that you have a history of managing credit responsibly. If you have any past due accounts, bringing them current as soon as possible can help your scores begin to recover.

Pay down credit card balances. Keeping balances on your credit cards low will help keep your credit utilization ratio at a good level.

Apply for credit only when you really need it. A credit application will typically result in a hard inquiry being added to your credit report. This can have a short-lived negative effect on your credit score. While the impact of one inquiry is typically minimal, the effect of multiple inquiries can compound if you submit frequent credit applications. Taking on a lot of new credit also reduces your average age of credit accounts, which can impact your score.

Understanding your credit profile can help you understand what lenders see when they look at your credit report. Getting your free credit score and credit report can show you where you are and what steps you may be able to take to improve your score.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analyses. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story originally appeared on Experian and has been independently reviewed to meet journalistic standards.

-

-

Apple rolls out buy now, pay later service: What to know

Matthias Schrader, Associated Press

FILE - The Apple logo is illuminated at a store in the city center in Munich, Germany, on Dec. 16, 2020.

Matthias Schrader, Associated Press

FILE - The Apple logo is illuminated at a store in the city center in Munich, Germany, on Dec. 16, 2020.