Apple appears poised to unveil a long-rumored headset that will place its users between the virtual and real world, while also testing the technology trendsetter’s ability to popularize new-fangled devices after others failed to capture the public’s imagination.

After years of speculation, the stage is set for the widely anticipated announcement to be made Monday at Apple’s annual developers conference in a Cupertino, California, theater named after the company’s late co-founder Steve Jobs. Apple is also likely to use the event to show off its latest Mac computer, preview the next operating system for the iPhone and discuss its strategy for artificial intelligence.

But the star of the show is expected to be a pair of goggles — perhaps called “Reality Pro,” according to media leaks — that could become another milestone in Apple’s lore of releasing game-changing technology, even though the company hasn’t always been the first to try its hand at making a particular device.

Apple’s lineage of breakthroughs date back to a bow-tied Jobs peddling the first Mac in 1984 —a tradition that continued with the iPod in 2001, the iPhone in 2007, the iPad in 2010, the Apple Watch in 2014 and its AirPods in 2016.

But with a hefty price tag that could be in the $3,000 range, Apple’s new headset may also be greeted with a lukewarm reception from all but affluent technophiles.

Eric Risberg, Associated Press

Apple CEO Tim Cook discusses the Apple Watch at the Apple event at the Bill Graham Civic Auditorium in San Francisco on Sept. 9, 2015.

If the new device turns out to be a niche product, it would leave Apple in the same bind as other major tech companies and startups that have tried selling headsets or glasses equipped with technology that either thrusts people into artificial worlds or projects digital images with scenery and things that are actually in front of them — a format known as “augmented reality.”

Apple’s goggles are expected be sleekly designed and capable of toggling between totally virtual or augmented options, a blend sometimes known as “mixed reality.” That flexibility also is sometimes called external reality, or XR for shorthand.

Facebook founder Mark Zuckerberg has been describing these alternate three-dimensional realities as the “metaverse.” It’s a geeky concept that he tried to push into the mainstream by changing the name of his social networking company to Meta Platforms in 2021 and then pouring billions of dollars into improving the virtual technology.

But the metaverse largely remains a digital ghost town, although Meta’s virtual reality headset, the Quest, remains the top-selling device in a category that so far has mostly appealed to video game players looking for even more immersive experiences.

Apple executives seem likely to avoid referring to the metaverse, given the skepticism that has quickly developed around that term, when they discuss the potential of the company’s new headset.

In recent years, Apple CEO Tim Cook has periodically touted augmented reality as technology’s next quantum leap, while not setting a specific timeline for when it will gain mass appeal.

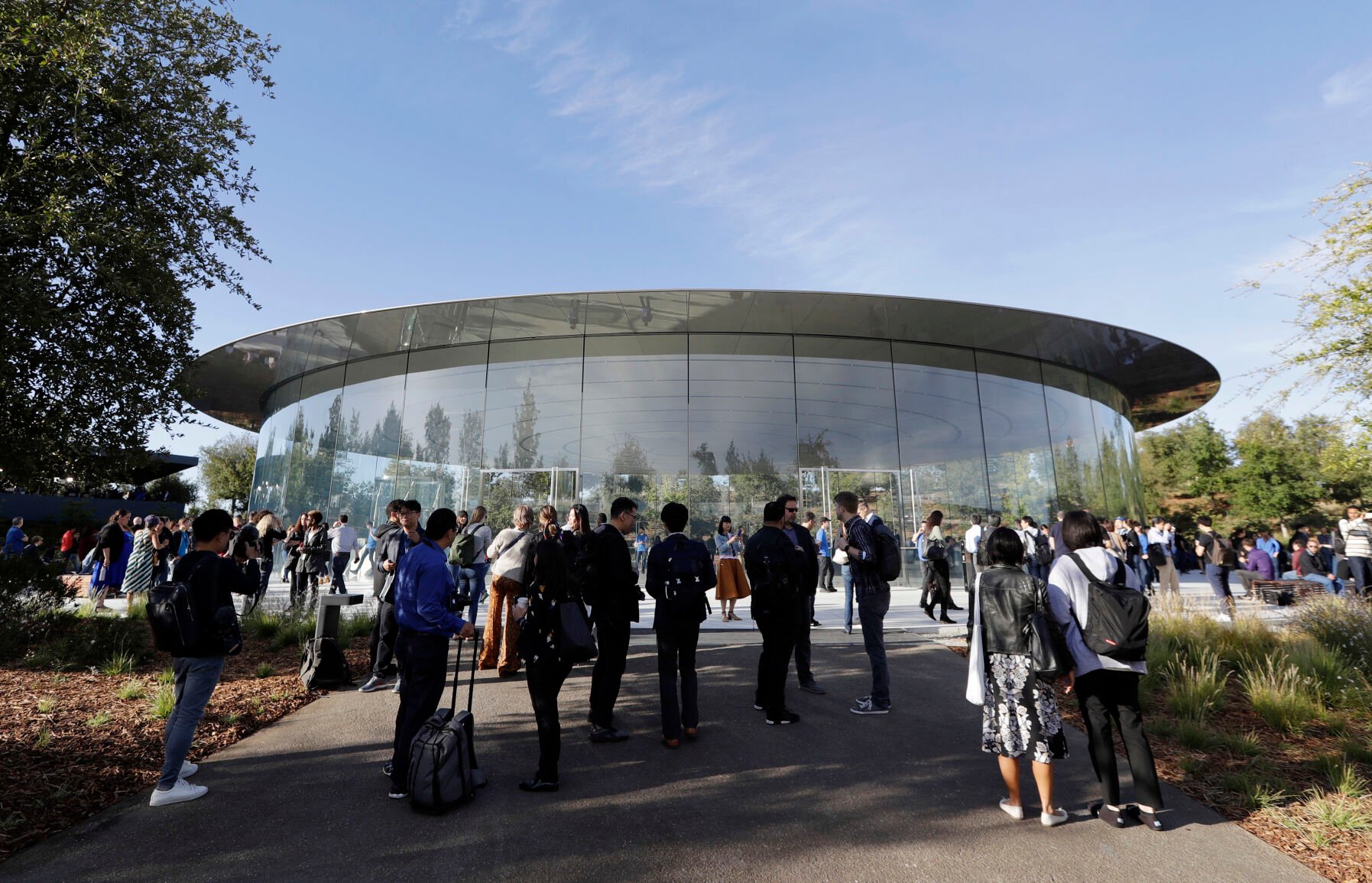

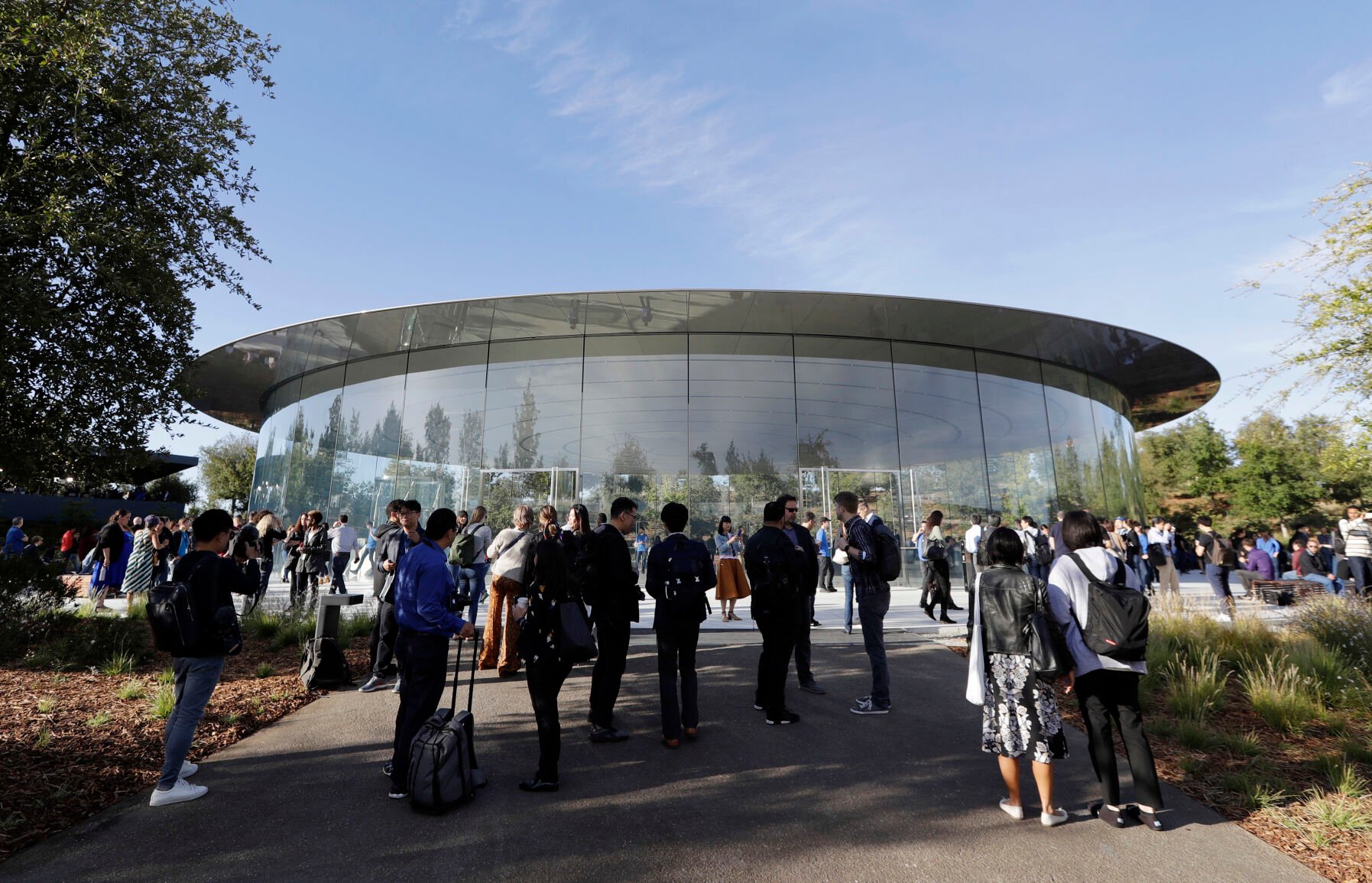

Marcio Jose Sanchez, Associated Press

People stand outside of the Steve Jobs Theater before an event on Wednesday, Sept. 12, 2018, in Cupertino, Calif.

“If you look back in a point in time, you know, zoom out to the future and look back, you’ll wonder how you led your life without augmented reality,” Cook, who is 62, said last September while speaking to an audience of students in Italy. “Just like today you wonder how did people like me grow up without the internet. You know, so I think it could be that profound. And it’s not going to be profound overnight.”

The response to virtual, augmented and mixed reality has been decidedly ho-hum so far. Some of the gadgets deploying the technology have even been derisively mocked, with the most notable example being Google’s internet-connected glasses released more than a decade ago.

After Google co-founder Sergey Brin initially drummed up excitement about the device by demonstrating an early model’s potential “wow factor” with a skydiving stunt staged during a San Francisco tech conference, consumers quickly became turned off to a product that allowed its users to surreptitiously take pictures and video. The backlash became so intense that people who wore the gear became known as “Glassholes,” leading Google to withdraw the product a few years after its debut.

Microsoft also has had limited success with HoloLens, a mixed-reality headset released in 2016, although the software maker earlier this year insisted it remains committed to the technology.

Magic Leap, a startup that stirred excitement with previews of a mixed-reality technology that could conjure the spectacle of a whale breaching through a gymnasium floor, had so much trouble marketing its first headset to consumers in 2018 that it has since shifted its focus to industrial, healthcare and emergency uses.

Daniel Diez, Magic Leap’s chief transformation officer, said there are four major questions Apple’s goggles will have to answer: “What can people do with it? What does this thing look and feel like? Is it comfortable to wear? And how much is it going to cost?”

The anticipation that Apple’s goggles are going to sell for several thousand dollars already has dampened expectations for the product. Although he expects Apple’s goggles to boast “jaw dropping” technology, Wedbush Securities analyst Dan Ives said he expects the company to sell just 150,000 units during the device’s first year on the market — a mere speck in the company’s portfolio. By comparison, Apple sells more than 200 million iPhones, its marquee product a year. But the iPhone wasn’t an immediate sensation, with sales of fewer than 12 million units in its first full year on the market.

In a move apparently aimed at magnifying the expected price of Apple’s goggles, Zuckerberg made a point of saying last week that the next Quest headset will sell for $500, an announcement made four months before Meta Platform plans to showcase the latest device at its tech conference.

Since 2016, the average annual shipments of virtual- and augmented-reality devices have averaged 8.6 million units, according to the research firm CCS Insight. The firm expects sales to remain sluggish this year, with a sales projection of about 11 million of the devices before gradually climbing to 67 million in 2026.

But those forecasts were obviously made before it’s known whether Apple might be releasing a product that alters the landscape.

“I would never count out Apple, especially with the consumer market and especially when it comes to finding those killer applications and solutions,” Magic Leap’s Diez said. “If someone is going to crack the consumer market early, I wouldn’t be surprised it would be Apple.”

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

rblfmr // Shutterstock

After the coronavirus struck in 2020, causing employees and students to work from home and social gatherings to shift online, demand for technology products soared. From computers to streaming services, the industry exploded. Sales of laptop and desktop computers, for example, totaled 348.8 million in 2020, a nearly 15% increase over 2019. That's the greatest number of sales since 2014.

To keep up with the growth, tech companies hired new workers.

Then the pandemic lessened its grip, and tech companies were left with a different set of problems: inflation, higher interest rates, and fears of a recession, among others. Layoffs began.

Facebook's parent company, Meta, for example, cut more than 10,000 workers in November 2022.

And as stock prices fell, technology giants assured shareholders they were taking steps to right the imbalance.

Stacker used Bureau of Labor Statistics data to identify 10 technology industries, then ranked the seven with the most job losses from December 2022 to March 2023, the most recent data available across all 10 industries. The other three tech industries—computer and software wholesalers, nanotech, and biotech—either experienced job gains or had little change in that time. The employment data is seasonally adjusted.

The technology jobs are mostly part of the information sector, which lost about 24,000 jobs from December 2022 to April 2023, largely in January and February. Preliminary estimates show that layoffs in the sector slowed in March and April but remain well above 2022 levels. Some technology industries are outside the information sector, namely in the professional and business services, manufacturing, and wholesale trade areas.

rblfmr // Shutterstock

After the coronavirus struck in 2020, causing employees and students to work from home and social gatherings to shift online, demand for technology products soared. From computers to streaming services, the industry exploded. Sales of laptop and desktop computers, for example, totaled 348.8 million in 2020, a nearly 15% increase over 2019. That's the greatest number of sales since 2014.

To keep up with the growth, tech companies hired new workers.

Then the pandemic lessened its grip, and tech companies were left with a different set of problems: inflation, higher interest rates, and fears of a recession, among others. Layoffs began.

Facebook's parent company, Meta, for example, cut more than 10,000 workers in November 2022.

And as stock prices fell, technology giants assured shareholders they were taking steps to right the imbalance.

Stacker used Bureau of Labor Statistics data to identify 10 technology industries, then ranked the seven with the most job losses from December 2022 to March 2023, the most recent data available across all 10 industries. The other three tech industries—computer and software wholesalers, nanotech, and biotech—either experienced job gains or had little change in that time. The employment data is seasonally adjusted.

The technology jobs are mostly part of the information sector, which lost about 24,000 jobs from December 2022 to April 2023, largely in January and February. Preliminary estimates show that layoffs in the sector slowed in March and April but remain well above 2022 levels. Some technology industries are outside the information sector, namely in the professional and business services, manufacturing, and wholesale trade areas.

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

Rawpixel.com // Shutterstock

- March 2023 employment: 171,100 jobs

- Change from...

--- February 2023: Up 1,600 jobs

--- December 2022: Down 1,300 jobs

--- February 2020 (pre-COVID): Up 23,100 jobs

Alphabet, the parent company of the best-known search engine, Google, announced in January 2023 that it was laying off 12,000 employees, or 6% of its workforce. In a memo, CEO Sundar Pichai said that after dramatic growth in the two previous years, the company had "hired for a different economic reality than the one we face today." The company came under sharp criticism for making the cuts by email.

Rawpixel.com // Shutterstock

- March 2023 employment: 171,100 jobs

- Change from...

--- February 2023: Up 1,600 jobs

--- December 2022: Down 1,300 jobs

--- February 2020 (pre-COVID): Up 23,100 jobs

Alphabet, the parent company of the best-known search engine, Google, announced in January 2023 that it was laying off 12,000 employees, or 6% of its workforce. In a memo, CEO Sundar Pichai said that after dramatic growth in the two previous years, the company had "hired for a different economic reality than the one we face today." The company came under sharp criticism for making the cuts by email.

-

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

Michael Vi // Shutterstock

- March 2023 employment: 485,200 jobs

- Change from...

--- February 2023: Up 2,200 jobs

--- December 2022: Down 1,500 jobs

--- February 2020 (pre-COVID): Up 122,500 jobs

GoDaddy laid off 500 workers, or 8% of its global employees, in February 2023. The domain registrar and web hosting company blamed "increasingly challenging macroeconomic conditions." Dropbox, which offers cloud storage and file-sharing services, shed the same number of employees in April 2023, about 18% of its workforce. It will be focusing on products driven by artificial intelligence and needs workers with different skills.

Michael Vi // Shutterstock

- March 2023 employment: 485,200 jobs

- Change from...

--- February 2023: Up 2,200 jobs

--- December 2022: Down 1,500 jobs

--- February 2020 (pre-COVID): Up 122,500 jobs

GoDaddy laid off 500 workers, or 8% of its global employees, in February 2023. The domain registrar and web hosting company blamed "increasingly challenging macroeconomic conditions." Dropbox, which offers cloud storage and file-sharing services, shed the same number of employees in April 2023, about 18% of its workforce. It will be focusing on products driven by artificial intelligence and needs workers with different skills.

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

YouraPechkin // Shutterstock

- March 2023 employment: 1.1 million jobs

- Change from...

--- February 2023: Down 2,500 jobs

--- December 2022: Down 1,700 jobs

--- February 2020 (pre-COVID): Up 17,900 jobs

Demand for personal computers and laptops has been falling after a burst of sales during the coronavirus pandemic. Dell announced in February that it would be letting go of more than 6,000 employees, or about 5% of its workforce, pointing to the "challenging global economic environment."

Intel, the manufacturer of semiconductor chips, said at the beginning of May that it would be cutting employees. That follows a first-quarter net loss of $2.8 billion, the largest in its history. But one of the best-known companies, Apple, is not looking at large-scale layoffs, according to CEO Tim Cook, who said at the beginning of May that layoffs would be a "last resort."

YouraPechkin // Shutterstock

- March 2023 employment: 1.1 million jobs

- Change from...

--- February 2023: Down 2,500 jobs

--- December 2022: Down 1,700 jobs

--- February 2020 (pre-COVID): Up 17,900 jobs

Demand for personal computers and laptops has been falling after a burst of sales during the coronavirus pandemic. Dell announced in February that it would be letting go of more than 6,000 employees, or about 5% of its workforce, pointing to the "challenging global economic environment."

Intel, the manufacturer of semiconductor chips, said at the beginning of May that it would be cutting employees. That follows a first-quarter net loss of $2.8 billion, the largest in its history. But one of the best-known companies, Apple, is not looking at large-scale layoffs, according to CEO Tim Cook, who said at the beginning of May that layoffs would be a "last resort."

-

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

Derick P. Hudson // Shutterstock

- March 2023 employment: 236,600 jobs

- Change from...

--- February 2023: Down 600 jobs

--- December 2022: Down 3,500 jobs

--- February 2020 (pre-COVID): Down 8,500 jobs

Facebook's parent company, Meta, said in November 2022 that it would reduce its staff by 11,000, or 13%. It was the company's first extensive round of layoffs since its founding in 2004. Meta CEO Mark Zuckerberg said the company had overhired during the pandemic when growth surged. Such powerhouses as Disney and Warner Bros. Discovery confronted cutbacks as they tried to grow their streaming businesses.

Derick P. Hudson // Shutterstock

- March 2023 employment: 236,600 jobs

- Change from...

--- February 2023: Down 600 jobs

--- December 2022: Down 3,500 jobs

--- February 2020 (pre-COVID): Down 8,500 jobs

Facebook's parent company, Meta, said in November 2022 that it would reduce its staff by 11,000, or 13%. It was the company's first extensive round of layoffs since its founding in 2004. Meta CEO Mark Zuckerberg said the company had overhired during the pandemic when growth surged. Such powerhouses as Disney and Warner Bros. Discovery confronted cutbacks as they tried to grow their streaming businesses.

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

REDPIXEL.PL // Shutterstock

- March 2023 employment: 2.5 million jobs

- Change from...

--- February 2023: Up 1,600 jobs

--- December 2022: Down 3,800 jobs

--- February 2020 (pre-COVID): Up 255,200 jobs

The layoffs in 2023 are reaching into the core of the technology sector affecting software engineers, data scientists, and other key roles. Software engineers represented nearly 20% of the cuts, though they make up only 14% of the workforce, according to an analysis by Revelio Labs for Vox. One reason why they might be newly vulnerable: the efficiencies that result from artificial intelligence.

REDPIXEL.PL // Shutterstock

- March 2023 employment: 2.5 million jobs

- Change from...

--- February 2023: Up 1,600 jobs

--- December 2022: Down 3,800 jobs

--- February 2020 (pre-COVID): Up 255,200 jobs

The layoffs in 2023 are reaching into the core of the technology sector affecting software engineers, data scientists, and other key roles. Software engineers represented nearly 20% of the cuts, though they make up only 14% of the workforce, according to an analysis by Revelio Labs for Vox. One reason why they might be newly vulnerable: the efficiencies that result from artificial intelligence.

-

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

Wachiwit // Shutterstock

- March 2023 employment: 646,000 jobs

- Change from...

--- February 2023: Down 1,200 jobs

--- December 2022: Down 5,200 jobs

--- February 2020 (pre-COVID): Up 144,200 jobs

Software publishers such as Microsoft and Salesforce have also watched growth slow. During the pandemic, interest in collaborative tools spiked as people worked and studied remotely. But as the world reopened, companies reined in spending. The maker of Windows let go of 10,000 employees in January, during which time Salesforce also announced it would lay off 8,000 employees, or 10% of its workers.

Wachiwit // Shutterstock

- March 2023 employment: 646,000 jobs

- Change from...

--- February 2023: Down 1,200 jobs

--- December 2022: Down 5,200 jobs

--- February 2020 (pre-COVID): Up 144,200 jobs

Software publishers such as Microsoft and Salesforce have also watched growth slow. During the pandemic, interest in collaborative tools spiked as people worked and studied remotely. But as the world reopened, companies reined in spending. The maker of Windows let go of 10,000 employees in January, during which time Salesforce also announced it would lay off 8,000 employees, or 10% of its workers.

-

Apple is expected to unveil a sleek, pricey headset. Is it the device VR has been looking for?

Fahroni // Shutterstock

- March 2023 employment: 600,300 jobs

- Change from...

--- February 2023: Down 2,400 jobs

--- December 2022: Down 5,900 jobs

--- February 2020 (pre-COVID): Down 60,600 jobs

Among the biggest cuts, the Swedish telecom Ericsson announced in February that it planned to decrease its worldwide workforce by 8,500 jobs, or 8%. The company provides equipment for 5G networks. It said it wants to cut costs by $859 million by the end of 2023.

Data reporting by Paxtyn Merten. Story editing by Jeff Inglis. Copy editing by Paris Close. Photo selection by Clarese Moller.

Fahroni // Shutterstock

- March 2023 employment: 600,300 jobs

- Change from...

--- February 2023: Down 2,400 jobs

--- December 2022: Down 5,900 jobs

--- February 2020 (pre-COVID): Down 60,600 jobs

Among the biggest cuts, the Swedish telecom Ericsson announced in February that it planned to decrease its worldwide workforce by 8,500 jobs, or 8%. The company provides equipment for 5G networks. It said it wants to cut costs by $859 million by the end of 2023.

Data reporting by Paxtyn Merten. Story editing by Jeff Inglis. Copy editing by Paris Close. Photo selection by Clarese Moller.