Personal loan rates from banks, credit unions and online lenders are up after repeated interest rate hikes from the Federal Reserve this year, the latest of which came last week.

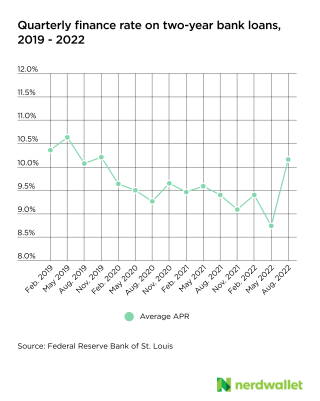

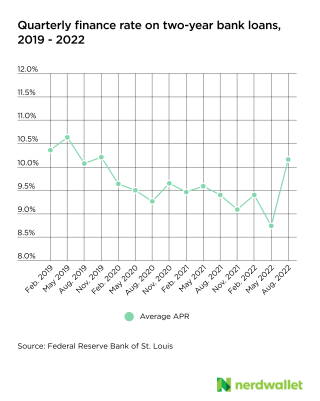

The finance rate on 24-month personal loans from banks jumped from 8.73% in May to 10.16% in August, according to the latest data from the Federal Reserve Bank of St. Louis. The average annual percentage rate on 36-month credit union loans rose from 8.84% in June to 9.15% in September, according to the National Credit Union Administration.

Most personal loans have fixed rates, so if you already have a personal loan, your monthly payments won’t change. But prospective borrowers could face higher monthly payments and may qualify for lower loan amounts compared to earlier this year.

Why are personal loan rates rising?

Until recently, lenders have kept rates relatively low for a few reasons.

Personal loan rates are somewhat tied to supply and demand, which is why they don’t follow the Federal Funds rate as closely as other financial products like mortgages do, says Werner Loots, U.S. Bank’s executive vice president of direct consumer lending.

And demand for personal loans has been high this year, Loots says, in part because personal loans are an attractive, fixed-rate financing option that can be used for almost anything at a time when prices are high for almost everything.

High demand fueled competition among lenders, which kept personal loan rates low even as the Fed rate climbed, says Salman Chand, TransUnion’s vice president of consumer lending.

But the Fed and the state of the economy could be putting pressure on lenders. A rising Fed rate, coupled with fears of an economic downturn, may push lenders to tighten their borrowing criteria and make fewer loans overall, triggering higher personal loan rates.

“If you’re not making as many loans and your cost of borrowing is going up, there’s no incentive for you to keep rates down and try to get as many consumers through the door,” Chand says.

Is it harder to qualify for a personal loan?

Lenders could tighten underwriting criteria if they believe a recession is likely, Chand says.

Because unsecured personal loans don’t require collateral, lenders rely on applicants’ credit profiles and finances to determine whether a borrower is likely to repay the loan.

Personal loan delinquency rates — the percentage of all loans that have past-due payments — have been steadily rising this year, and in the third quarter surpassed pre-pandemic levels, according to a credit industry report from TransUnion.

Rising delinquency rates are one signal lenders use to decide whether to tighten approval standards, Chand says. If they do, consumers with fair or bad credit scores (generally below 689) could struggle to qualify.

Growing unemployment could also trigger tougher borrowing standards because lenders are worried about making loans to consumers who could be laid off, says Katherine Fox, a certified financial planner and founder of Sunnybranch Wealth based in Portland, Oregon.

So far this year, unemployment has remained consistently low.

Even if lenders don’t tighten their approval criteria, higher rates mean you may qualify for a lower loan amount than you would have earlier this year, Fox says.

When deciding whether to approve your application, lenders review how much of your monthly income goes toward debt payments, also called your debt-to-income ratio. They include the potential personal loan payment in that calculation.

For example, if a lender only accepts borrowers with DTIs below 40%, that would mean all of your current debt payments, plus your new personal loan payment, couldn’t cost more than 40% of your monthly income.

Higher personal loan rates mean higher monthly payments, so a lender may approve you for a smaller loan to avoid overextending you, she says.

Getty Images

After several Federal Reserve interest rate hikes, prospective borrowers now could face higher monthly payments and may qualify for lower loan amounts compared to earlier this year.

Is now a good time to get a personal loan?

Your rate today may not be as low as it would have been a few months ago, Fox says, but it could get higher.

If you’re planning to apply for a personal loan in the coming months, it’s smart to shop around and lock in a rate before they rise again, she says.

For non-urgent expenses like home improvements and vacations, getting the most ideal APR means waiting. If rates do fall, it probably won’t be for at least a few months, Fox says.

“It’s either act fast or be totally flexible because that rate drop might come sooner than any of us think it will or it might take longer,” she says.

Rates are up across other financial products like home equity loans and credit cards, but it’s still smart to compare other options to see where you get the lowest rate, says Ian Bloom, CFP and owner of Open World Financial Life Planning in Raleigh, North Carolina.

Those with enough equity in their homes may get a better rate on equity financing than they would on a personal loan, and consumers with strong credit may qualify for a 0% APR credit card, he says. With a zero-interest credit card, pay the balance during the promotional period to avoid a high rate.

Tips to lower your personal loan rate

Rising APRs mean you may have to take more steps to get a low rate. Here are some tips to improve your chances of qualifying for an affordable loan.

Pre-qualify. Pre-qualifying lets you check your personal loan amount, rate and repayment term without a ding to your credit. Online lenders, banks and credit unions offer pre-qualification — and even if your bank doesn’t, you can take a pre-qualified offer to it and ask if it’ll beat that offer.

Consider a co-applicant or collateral. If your credit or DTI could prevent you from getting a low rate, consider a co-signed, joint or secured loan. With a co-signed or joint loan, you add someone with better credit and a higher income to your application, and they promise to repay the loan if you fail to do so. With a secured loan, you provide collateral in exchange for a lower rate or larger loan, but the lender can take the property if you miss payments.

Build your credit and lower your debt. The best way to get a good rate is to have good or excellent credit (a score of 690 or higher) and a low DTI. If you’re not getting the offers you want through pre-qualification, it’s time to consider alternative borrowing options and work on paying down debt, which can build your credit and lower your DTI.

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Economic and business news in the United States is currently full of fear over the possibility of a recession. Near-historic inflation has caused the prices of everything from groceries to fuel to soar and has brought many Americans' ability and willingness to spend money into question. Because consumer spending is one of the major drivers of the economy, reduced spending could stifle economic growth; some experts are predicting a potential "stagflation"—a combination of economic stagnation and inflation and a possible precursor to recession—moving into the final two quarters of 2022.

A recession is defined as an economic contraction, which means that economic activity has moved from a high point to a low point. The popular definition of a recession, as defined by many economists, requires two consecutive quarters of negative real gross domestic product (GDP) growth; however, the National Bureau of Economic Research doesn't strictly abide by this designation. Many other factors contribute to the economy's health and can be used to determine whether or not it is heading toward a recession. Among these are unemployment figures, the health of the bond market, and retail sales.

A vigorous debate is currently underway over whether the United States is headed toward a recession or not. Although the Federal Reserve has maintained that the U.S. economy is not headed toward a recession, some economists remain skeptical of the Fed's position.

So which is correct? While it's almost impossible to predict with any certainty, some metrics are more commonly used than others to forecast possible trouble ahead. Stacker cited data from the Federal Reserve Banks of St. Louis and New York, the U.S. Census Bureau, and the Bureau of Labor Statistics to explore how six economic indicators have preceded recessions.

You may also like: Iconic buildings that were demolished

Emma Rubin // Stacker

Economic and business news in the United States is currently full of fear over the possibility of a recession. Near-historic inflation has caused the prices of everything from groceries to fuel to soar and has brought many Americans' ability and willingness to spend money into question. Because consumer spending is one of the major drivers of the economy, reduced spending could stifle economic growth; some experts are predicting a potential "stagflation"—a combination of economic stagnation and inflation and a possible precursor to recession—moving into the final two quarters of 2022.

A recession is defined as an economic contraction, which means that economic activity has moved from a high point to a low point. The popular definition of a recession, as defined by many economists, requires two consecutive quarters of negative real gross domestic product (GDP) growth; however, the National Bureau of Economic Research doesn't strictly abide by this designation. Many other factors contribute to the economy's health and can be used to determine whether or not it is heading toward a recession. Among these are unemployment figures, the health of the bond market, and retail sales.

A vigorous debate is currently underway over whether the United States is headed toward a recession or not. Although the Federal Reserve has maintained that the U.S. economy is not headed toward a recession, some economists remain skeptical of the Fed's position.

So which is correct? While it's almost impossible to predict with any certainty, some metrics are more commonly used than others to forecast possible trouble ahead. Stacker cited data from the Federal Reserve Banks of St. Louis and New York, the U.S. Census Bureau, and the Bureau of Labor Statistics to explore how six economic indicators have preceded recessions.

You may also like: Iconic buildings that were demolished

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

A yield curve is a curve on a graph that measures the yield of fixed-interest securities against the length of time they have to run to maturity. Inversions in the yield curve were often thought to be reliable indicators of looming recessions; however, some economists believe that the yield curve is a less reliable metric of recessions than it once was due to central banks' efforts to prop up bond markets. For example, the yield curve inverted in 1966, but a recession didn't come until 1969. So the fact that the yield curve has inverted twice in the past year doesn't mean recession is inevitable, but it's something to keep an eye on.

Emma Rubin // Stacker

A yield curve is a curve on a graph that measures the yield of fixed-interest securities against the length of time they have to run to maturity. Inversions in the yield curve were often thought to be reliable indicators of looming recessions; however, some economists believe that the yield curve is a less reliable metric of recessions than it once was due to central banks' efforts to prop up bond markets. For example, the yield curve inverted in 1966, but a recession didn't come until 1969. So the fact that the yield curve has inverted twice in the past year doesn't mean recession is inevitable, but it's something to keep an eye on.

-

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Unemployment is often thought of as one of the primary indicators of a recession. Along with falling stock prices, it indicates that business sentiment is pessimistic. Many economists believe that unemployment rates offer the closest thing to a real-time warning of a recession. Economists at the Brookings Institution have said that if the unemployment rate is .5 percentage points above its minimum for the prior year, the economy is headed toward a recession. But if the United States is heading towards a recession now, it will throw a wrench into that hypothesis: Jobs are currently being added to the economy to the tune of over half a million per month.

Emma Rubin // Stacker

Unemployment is often thought of as one of the primary indicators of a recession. Along with falling stock prices, it indicates that business sentiment is pessimistic. Many economists believe that unemployment rates offer the closest thing to a real-time warning of a recession. Economists at the Brookings Institution have said that if the unemployment rate is .5 percentage points above its minimum for the prior year, the economy is headed toward a recession. But if the United States is heading towards a recession now, it will throw a wrench into that hypothesis: Jobs are currently being added to the economy to the tune of over half a million per month.

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Car repossessions have been thought to be predictors of economic trouble for a fairly obvious reason: When the economy is doing poorly, many individuals within it are also doing poorly, which means they may not be able to keep up with their car payments. As such, repossessions of cars may predict economic trouble ahead; however, current rates of delinquencies are not high, historically speaking. So by this measure, a recession is not necessarily on the horizon.

Emma Rubin // Stacker

Car repossessions have been thought to be predictors of economic trouble for a fairly obvious reason: When the economy is doing poorly, many individuals within it are also doing poorly, which means they may not be able to keep up with their car payments. As such, repossessions of cars may predict economic trouble ahead; however, current rates of delinquencies are not high, historically speaking. So by this measure, a recession is not necessarily on the horizon.

-

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Retail sales are considered an important economic indicator because they illuminate how much customers are willing and able to spend. Consumer spending drives a significant portion of the U.S. economy. So if customers pull back on spending, it may not only indicate that a recession is coming; it might also further that recession. For this reason, politicians sometimes propose tax rebates, betting that if they put money in consumers' pockets, consumers will spend, which will help to stabilize the economy. Despite some experts' warnings that a recession is near, current retail sales in the U.S. are relatively steady, potentially reflecting post-pandemic demand as much as the state of the overall economy.

Emma Rubin // Stacker

Retail sales are considered an important economic indicator because they illuminate how much customers are willing and able to spend. Consumer spending drives a significant portion of the U.S. economy. So if customers pull back on spending, it may not only indicate that a recession is coming; it might also further that recession. For this reason, politicians sometimes propose tax rebates, betting that if they put money in consumers' pockets, consumers will spend, which will help to stabilize the economy. Despite some experts' warnings that a recession is near, current retail sales in the U.S. are relatively steady, potentially reflecting post-pandemic demand as much as the state of the overall economy.

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Many economists believe that rising inflation increases the likelihood of a recession. A recent Consumer Price Index report showed that year-over-year inflation has reached 9.1%. This is the highest rate since 1981, when the economy did, indeed, enter a recession. Inflation is generally the key metric by which many banks are now forecasting a recession. Wells Fargo's chief economist called current inflation data "ugly" and noted that it was becoming more pervasive and long-lasting.

The Inflation Reduction Act recently passed in the U.S. aims to reduce the federal deficit while investing in production and manufacturing. It will also curb the cost of prescription drugs and create a minimum 15% tax for corporations earning more than $1 billion annually. It is a reduced version of the Biden administration's earlier Build Back Better plan.

Emma Rubin // Stacker

Many economists believe that rising inflation increases the likelihood of a recession. A recent Consumer Price Index report showed that year-over-year inflation has reached 9.1%. This is the highest rate since 1981, when the economy did, indeed, enter a recession. Inflation is generally the key metric by which many banks are now forecasting a recession. Wells Fargo's chief economist called current inflation data "ugly" and noted that it was becoming more pervasive and long-lasting.

The Inflation Reduction Act recently passed in the U.S. aims to reduce the federal deficit while investing in production and manufacturing. It will also curb the cost of prescription drugs and create a minimum 15% tax for corporations earning more than $1 billion annually. It is a reduced version of the Biden administration's earlier Build Back Better plan.

-

-

What rising personal loan rates mean for borrowers

Emma Rubin // Stacker

Many economists consider two consecutive quarters of negative GDP growth an indication that a recession is coming; they also use this benchmark to determine whether a recession has already occurred. Other experts think that GDP doesn't tell the whole story. For example, according to Fidelity, one portfolio manager recently said that the GDP isn't great at predicting the future: "One limitation of GDP is that it's a backward-looking indicator," he said. He further pointed out that the stock market often rose after these two negative quarters, complicating the hypothesis that GDP predicts recessions.

Emma Rubin // Stacker

Many economists consider two consecutive quarters of negative GDP growth an indication that a recession is coming; they also use this benchmark to determine whether a recession has already occurred. Other experts think that GDP doesn't tell the whole story. For example, according to Fidelity, one portfolio manager recently said that the GDP isn't great at predicting the future: "One limitation of GDP is that it's a backward-looking indicator," he said. He further pointed out that the stock market often rose after these two negative quarters, complicating the hypothesis that GDP predicts recessions.