Biden still plans to restart federal student loan payments in February. Here’s how you can prepare

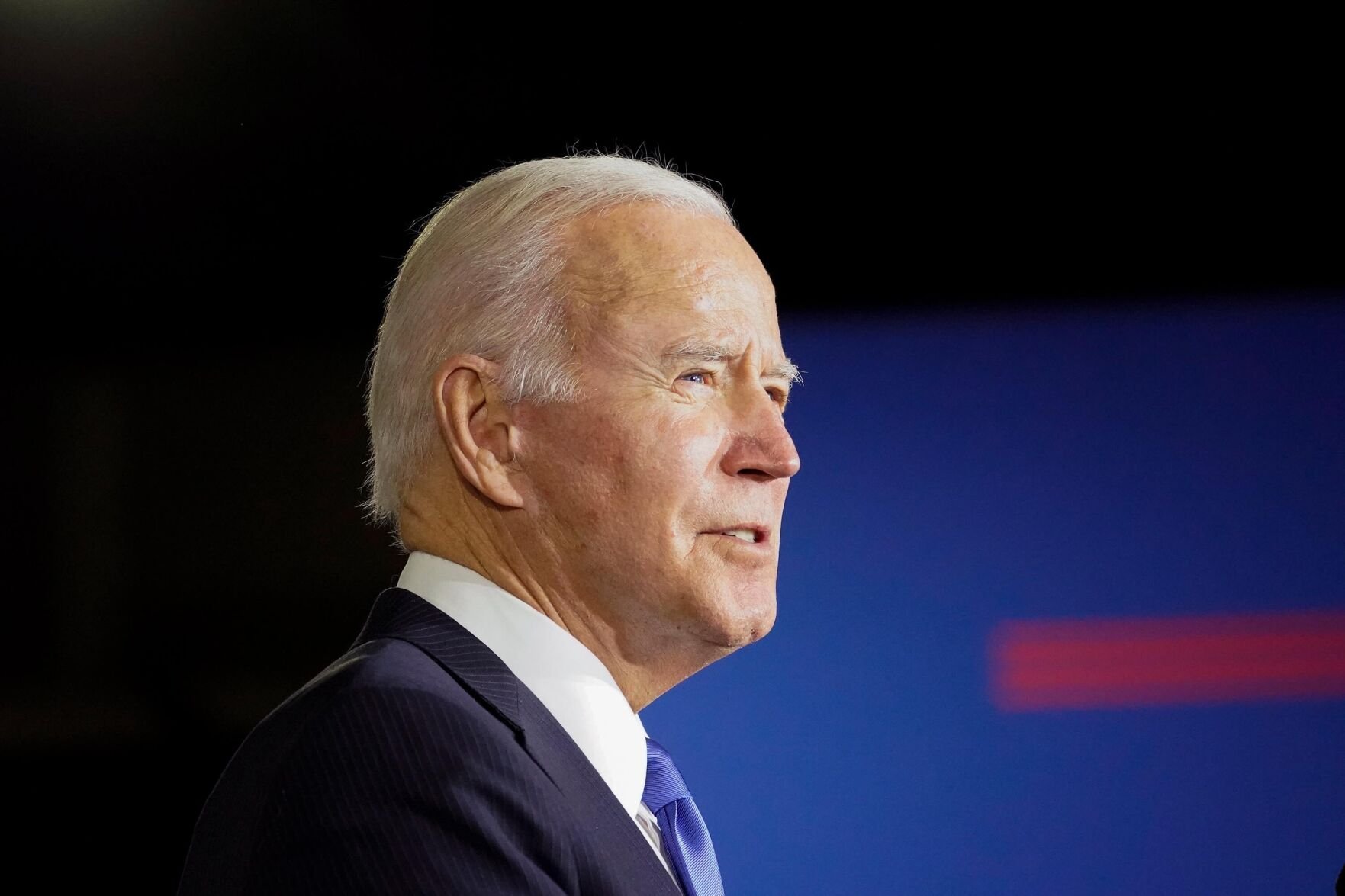

President Joe Biden still plans to restart federal student loan payments in February, resisting pressure from some fellow Democrats who continue to call for an extension of coronavirus pandemic relief benefits.

“We’re still assessing the impact of the Omicron variant, but a smooth transition back into repayment is a high priority for the administration,” said White House press secretary Jen Psaki when asked Friday whether the administration would consider extending the student loan payment pause.

“In the coming weeks, we will release more details about our plan and will engage directly with student loan borrowers to ensure that they have the resources they need and are in the appropriate repayment plan,” she added.

Borrower balances have effectively been frozen for nearly two years, with no payments required on most federal student loans since March 2020. During this time, interest has stopped adding up and collections on defaulted debt have been on hold.

Both Biden and former President Donald Trump took actions to extend the pause. Most recently, Biden moved the payment restart date from Sept. 30, 2021, to Jan. 31, 2022, but the administration made clear at the time that this would be the final extension.

Some Democrats urge Biden to extend relief

Alex Brandon/AP

President Joe Biden still plans to restart federal student loan payments in February, resisting pressure from some fellow Democrats who continue to call for an extension of coronavirus pandemic relief benefits.

Senate Majority Leader Chuck Schumer of New York, Sen. Elizabeth Warren and Rep. Ayanna Pressley, both of Massachusetts, have been pressuring Biden to extend the student loan repayment pause.

“The pause on federal student loan payments, interest, and collections has improved borrowers’ economic security, allowing them to invest in their families, save for emergencies, and pay down other debt,” the lawmakers wrote in a letter to the President last week.

Before the pause, borrowers were paying an average of $393 a month for their federal student loans, according to an analysis from the Roosevelt Institute, which was provided to Schumer and Warren at their request. That means that collectively, borrowers will be paying roughly $7 billion a month, or about $85 billion a year, once the payments resume.

Schumer, Warren and Pressley are also continuing to urge Biden to take further action and cancel up to $50,000 of student loan debt per borrower.

Biden said during the presidential campaign that he would support canceling $10,000 per borrower, but has not taken action to do so beyond directing federal agencies to conduct reviews on whether he has the authority.

He has repeatedly resisted pressure to cancel up to $50,000 per borrower since taking office — making it very clear during a CNN town hall early in the year that he does not support the idea.

Separately, since taking office, Biden’s Department of Education has made it easier for people who were defrauded by for-profit colleges to seek debt relief. It has also temporarily expanded the Public Service Loan Forgiveness program that cancels outstanding debt for qualifying public service workers after they have made payments for 10 years.

Preparing for payments to resume

Most borrowers with federal student loans have not had to make any payments since March 2020. Direct Loans as well as PLUS loans, which are available to graduate school students and parents on behalf of their children, are eligible for the benefit. Some federal loans that are guaranteed by the government but not technically held by it, known as Federal Family Education Loans, or FFEL, did not qualify. Generally, those were disbursed prior to 2010.

The relief is even more significant for those who work in the public sector and may be eligible for federal student loan forgiveness after 10 years. They are still receiving credit toward those 10 years of required payments as if they had continued to make them during the pandemic, as long as they are still working full time for qualifying employers.

Borrowers will receive a billing statement or other notice at least 21 days before their payment is due, according to the Department of Education. Those who had set up auto payments may need to notify their loan servicing company they want those to continue.

If federal student loan borrowers can no longer afford their monthly payment, they may be eligible for an income-driven repayment plan. Under those plans, which are based on income and family size, a monthly payment can be as low as $0 a month. The Department of Education has more information online about the payment restart.

***

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareNDAB Creativity // Shutterstock

The pursuit of higher education has been an integral step in achieving the American Dream since James Truslow Adams coined the phrase in 1931. He defined the American Dream as the hope for “a better, richer and happier life for all our citizens of every rank.” Collectively, though, people in the United States have racked up $1.7 trillion in debt on this step alone.

Data tells us that, for some, a college degree is one means to this end. Over the course of a lifetime in the same career, a worker with a bachelor’s degree can earn roughly $1 million more than a worker with a high school diploma as their highest educational attainment. That earnings gap grows significantly with every advanced degree, but that long-term financial gain comes with a price tag that could take close to a lifetime to pay off.

America’s current student debt crisis is inextricably linked to legislation, social norms, and macroeconomic trends of the last half-century. Still, 43 million people in the U.S. have made the trade-off between carrying tens of thousands of dollars in federal student loans for higher earning potential down the road.

Decades of tax cuts to state funding for higher education have resulted in tuition hikes at both public and private institutions. Since 2000, the average cost of college per student has tripled to $35,720 per year. These exorbitant costs have outpaced currency inflation, leading to increasing debt loads and stagnant wages when it comes time for repayment.

Cautionary tales of graduates being saddled with six-figure debt sums are often used to contextualize the near-incomprehensible $1.7 trillion figure. For some, like lawyers, doctors, dentists, and veterinarians, those stories—and sums—are accurate. For the person pursuing an undergraduate degree, however, their total is notably less—$29,000, on average.

But the burden of repayment is borne differently from borrower to borrower. For example, Black graduates are five times more likely to default on loan repayment compared to their white peers due to lower median earnings. And their total debt is likely to be higher—an average of $52,000 for a bachelor’s degree. Women are forced to finance advanced degrees just to close the gender pay gap, ultimately earning—even with a master’s degree—what a man in the same role would earn with a bachelor’s degree. For roughly 20% of borrowers, financing their pursuit of higher education is not a step toward the American Dream, but a roadblock. While various proposals for loan forgiveness have been floated, like canceling $10,000 for every borrower, or deciding forgiveness-based income thresholds, none have been instituted to date.

On a larger scale, student loan debt can also vary significantly from state to state. StudySoup analyzed household debt statistics from the Federal Reserve of New York to understand how the average amount of student debt has grown across all 50 states.

States are ranked by percent change in student debt per capita between the fourth quarter of 2003 and the fourth quarter of 2020, the most recent period available. The Federal Reserve calculates historical student debt per capita, meaning the state statistics are calculated based on total population rather than number of borrowers. Additional data for 2020 on average debt per borrower is also included.

NDAB Creativity // Shutterstock

NDAB Creativity // ShutterstockThe pursuit of higher education has been an integral step in achieving the American Dream since James Truslow Adams coined the phrase in 1931. He defined the American Dream as the hope for “a better, richer and happier life for all our citizens of every rank.” Collectively, though, people in the United States have racked up $1.7 trillion in debt on this step alone.

Data tells us that, for some, a college degree is one means to this end. Over the course of a lifetime in the same career, a worker with a bachelor’s degree can earn roughly $1 million more than a worker with a high school diploma as their highest educational attainment. That earnings gap grows significantly with every advanced degree, but that long-term financial gain comes with a price tag that could take close to a lifetime to pay off.

America’s current student debt crisis is inextricably linked to legislation, social norms, and macroeconomic trends of the last half-century. Still, 43 million people in the U.S. have made the trade-off between carrying tens of thousands of dollars in federal student loans for higher earning potential down the road.

Decades of tax cuts to state funding for higher education have resulted in tuition hikes at both public and private institutions. Since 2000, the average cost of college per student has tripled to $35,720 per year. These exorbitant costs have outpaced currency inflation, leading to increasing debt loads and stagnant wages when it comes time for repayment.

Cautionary tales of graduates being saddled with six-figure debt sums are often used to contextualize the near-incomprehensible $1.7 trillion figure. For some, like lawyers, doctors, dentists, and veterinarians, those stories—and sums—are accurate. For the person pursuing an undergraduate degree, however, their total is notably less—$29,000, on average.

But the burden of repayment is borne differently from borrower to borrower. For example, Black graduates are five times more likely to default on loan repayment compared to their white peers due to lower median earnings. And their total debt is likely to be higher—an average of $52,000 for a bachelor’s degree. Women are forced to finance advanced degrees just to close the gender pay gap, ultimately earning—even with a master’s degree—what a man in the same role would earn with a bachelor’s degree. For roughly 20% of borrowers, financing their pursuit of higher education is not a step toward the American Dream, but a roadblock. While various proposals for loan forgiveness have been floated, like canceling $10,000 for every borrower, or deciding forgiveness-based income thresholds, none have been instituted to date.

On a larger scale, student loan debt can also vary significantly from state to state. StudySoup analyzed household debt statistics from the Federal Reserve of New York to understand how the average amount of student debt has grown across all 50 states.

States are ranked by percent change in student debt per capita between the fourth quarter of 2003 and the fourth quarter of 2020, the most recent period available. The Federal Reserve calculates historical student debt per capita, meaning the state statistics are calculated based on total population rather than number of borrowers. Additional data for 2020 on average debt per borrower is also included.

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareNDAB Creativity // Shutterstock

- Student debt per capita, 2020: $4,590 (149.5% increase since 2003)

- Student debt per capita, 2003: $1,840

- Total number of borrowers, 2020: 96,500 ($27,100 average debt per borrower)

NDAB Creativity // Shutterstock- Student debt per capita, 2020: $4,590 (149.5% increase since 2003)

- Student debt per capita, 2003: $1,840

- Total number of borrowers, 2020: 96,500 ($27,100 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareRawpixel.com // Shutterstock

- Student debt per capita, 2020: $5,260 (197.2% increase since 2003)

- Student debt per capita, 2003: $1,770

- Total number of borrowers, 2020: 130,500 ($28,600 average debt per borrower)

Rawpixel.com // Shutterstock- Student debt per capita, 2020: $5,260 (197.2% increase since 2003)

- Student debt per capita, 2003: $1,770

- Total number of borrowers, 2020: 130,500 ($28,600 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareAreipa.lt // Shutterstock

- Student debt per capita, 2020: $6,190 (211.1% increase since 2003)

- Student debt per capita, 2003: $1,990

- Total number of borrowers, 2020: 92,400 ($34,700 average debt per borrower)

Areipa.lt // Shutterstock- Student debt per capita, 2020: $6,190 (211.1% increase since 2003)

- Student debt per capita, 2003: $1,990

- Total number of borrowers, 2020: 92,400 ($34,700 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $5,290 (252.7% increase since 2003)

- Student debt per capita, 2003: $1,500

- Total number of borrowers, 2020: 459,800 ($29,600 average debt per borrower)

ESB Professional // Shutterstock- Student debt per capita, 2020: $5,290 (252.7% increase since 2003)

- Student debt per capita, 2003: $1,500

- Total number of borrowers, 2020: 459,800 ($29,600 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $5,270 (268.5% increase since 2003)

- Student debt per capita, 2003: $1,430

- Total number of borrowers, 2020: 264,200 ($31,300 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $5,270 (268.5% increase since 2003)

- Student debt per capita, 2003: $1,430

- Total number of borrowers, 2020: 264,200 ($31,300 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareGaudiLab // Shutterstock

- Student debt per capita, 2020: $4,720 (271.7% increase since 2003)

- Student debt per capita, 2003: $1,270

- Total number of borrowers, 2020: 132,300 ($32,100 average debt per borrower)

GaudiLab // Shutterstock- Student debt per capita, 2020: $4,720 (271.7% increase since 2003)

- Student debt per capita, 2003: $1,270

- Total number of borrowers, 2020: 132,300 ($32,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareGorodenkoff // Shutterstock

- Student debt per capita, 2020: $4,890 (294.4% increase since 2003)

- Student debt per capita, 2003: $1,240

- Total number of borrowers, 2020: 219,900 ($33,500 average debt per borrower)

Gorodenkoff // Shutterstock- Student debt per capita, 2020: $4,890 (294.4% increase since 2003)

- Student debt per capita, 2003: $1,240

- Total number of borrowers, 2020: 219,900 ($33,500 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparegaretsworkshop // Shutterstock

- Student debt per capita, 2020: $5,500 (298.6% increase since 2003)

- Student debt per capita, 2003: $1,380

- Total number of borrowers, 2020: 156,100 ($32,700 average debt per borrower)

garetsworkshop // Shutterstock- Student debt per capita, 2020: $5,500 (298.6% increase since 2003)

- Student debt per capita, 2003: $1,380

- Total number of borrowers, 2020: 156,100 ($32,700 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareNejron Photo // Shutterstock

- Student debt per capita, 2020: $5,020 (325.4% increase since 2003)

- Student debt per capita, 2003: $1,180

- Total number of borrowers, 2020: 786,600 ($30,700 average debt per borrower)

Nejron Photo // Shutterstock- Student debt per capita, 2020: $5,020 (325.4% increase since 2003)

- Student debt per capita, 2003: $1,180

- Total number of borrowers, 2020: 786,600 ($30,700 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareG-Stock Studio // Shutterstock

- Student debt per capita, 2020: $6,160 (333.8% increase since 2003)

- Student debt per capita, 2003: $1,420

- Total number of borrowers, 2020: 2,613,400 ($37,500 average debt per borrower)

G-Stock Studio // Shutterstock- Student debt per capita, 2020: $6,160 (333.8% increase since 2003)

- Student debt per capita, 2003: $1,420

- Total number of borrowers, 2020: 2,613,400 ($37,500 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparesirtravelalot // Shutterstock

- Student debt per capita, 2020: $5,960 (338.2% increase since 2003)

- Student debt per capita, 2003: $1,360

- Total number of borrowers, 2020: 226,000 ($33,700 average debt per borrower)

sirtravelalot // Shutterstock- Student debt per capita, 2020: $5,960 (338.2% increase since 2003)

- Student debt per capita, 2003: $1,360

- Total number of borrowers, 2020: 226,000 ($33,700 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJacob Lund // Shutterstock

- Student debt per capita, 2020: $6,300 (340.6% increase since 2003)

- Student debt per capita, 2003: $1,430

- Total number of borrowers, 2020: 888,700 ($32,200 average debt per borrower)

Jacob Lund // Shutterstock- Student debt per capita, 2020: $6,300 (340.6% increase since 2003)

- Student debt per capita, 2003: $1,430

- Total number of borrowers, 2020: 888,700 ($32,200 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $6,190 (342.1% increase since 2003)

- Student debt per capita, 2003: $1,400

- Total number of borrowers, 2020: 1,040,400 ($34,400 average debt per borrower)

ESB Professional // Shutterstock- Student debt per capita, 2020: $6,190 (342.1% increase since 2003)

- Student debt per capita, 2003: $1,400

- Total number of borrowers, 2020: 1,040,400 ($34,400 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparefizkes // Shutterstock

- Student debt per capita, 2020: $4,410 (350.0% increase since 2003)

- Student debt per capita, 2003: $980

- Total number of borrowers, 2020: 833,000 ($35,400 average debt per borrower)

fizkes // Shutterstock- Student debt per capita, 2020: $4,410 (350.0% increase since 2003)

- Student debt per capita, 2003: $980

- Total number of borrowers, 2020: 833,000 ($35,400 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $6,310 (357.2% increase since 2003)

- Student debt per capita, 2003: $1,380

- Total number of borrowers, 2020: 808,900 ($36,300 average debt per borrower)

ESB Professional // Shutterstock- Student debt per capita, 2020: $6,310 (357.2% increase since 2003)

- Student debt per capita, 2003: $1,380

- Total number of borrowers, 2020: 808,900 ($36,300 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareGaudiLab // Shutterstock

- Student debt per capita, 2020: $4,400 (363.2% increase since 2003)

- Student debt per capita, 2003: $950

- Total number of borrowers, 2020: 218,000 ($32,100 average debt per borrower)

GaudiLab // Shutterstock- Student debt per capita, 2020: $4,400 (363.2% increase since 2003)

- Student debt per capita, 2003: $950

- Total number of borrowers, 2020: 218,000 ($32,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $5,540 (365.5% increase since 2003)

- Student debt per capita, 2003: $1,190

- Total number of borrowers, 2020: 205,400 ($32,700 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $5,540 (365.5% increase since 2003)

- Student debt per capita, 2003: $1,190

- Total number of borrowers, 2020: 205,400 ($32,700 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareCrizzyStudio // Shutterstock

- Student debt per capita, 2020: $4,640 (378.4% increase since 2003)

- Student debt per capita, 2003: $970

- Total number of borrowers, 2020: 3,987,700 ($37,100 average debt per borrower)

CrizzyStudio // Shutterstock- Student debt per capita, 2020: $4,640 (378.4% increase since 2003)

- Student debt per capita, 2003: $970

- Total number of borrowers, 2020: 3,987,700 ($37,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparemangpor2004 // Shutterstock

- Student debt per capita, 2020: $5,590 (390.4% increase since 2003)

- Student debt per capita, 2003: $1,140

- Total number of borrowers, 2020: 391,000 ($32,800 average debt per borrower)

mangpor2004 // Shutterstock- Student debt per capita, 2020: $5,590 (390.4% increase since 2003)

- Student debt per capita, 2003: $1,140

- Total number of borrowers, 2020: 391,000 ($32,800 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJust Life // Shutterstock

- Student debt per capita, 2020: $4,150 (400.0% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 217,100 ($34,000 average debt per borrower)

Just Life // Shutterstock- Student debt per capita, 2020: $4,150 (400.0% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 217,100 ($34,000 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareGorodenkoff // Shutterstock

- Student debt per capita, 2020: $5,410 (400.9% increase since 2003)

- Student debt per capita, 2003: $1,080

- Total number of borrowers, 2020: 856,700 ($36,100 average debt per borrower)

Gorodenkoff // Shutterstock- Student debt per capita, 2020: $5,410 (400.9% increase since 2003)

- Student debt per capita, 2003: $1,080

- Total number of borrowers, 2020: 856,700 ($36,100 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparemavo // Shutterstock

- Student debt per capita, 2020: $3,700 (406.8% increase since 2003)

- Student debt per capita, 2003: $730

- Total number of borrowers, 2020: 127,300 ($34,800 average debt per borrower)

mavo // Shutterstock- Student debt per capita, 2020: $3,700 (406.8% increase since 2003)

- Student debt per capita, 2003: $730

- Total number of borrowers, 2020: 127,300 ($34,800 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareLightField Studios // Shutterstock

- Student debt per capita, 2020: $6,520 (413.4% increase since 2003)

- Student debt per capita, 2003: $1,270

- Total number of borrowers, 2020: 2,069,500 ($34,900 average debt per borrower)

LightField Studios // Shutterstock- Student debt per capita, 2020: $6,520 (413.4% increase since 2003)

- Student debt per capita, 2003: $1,270

- Total number of borrowers, 2020: 2,069,500 ($34,900 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareKate Kultsevych // Shutterstock

- Student debt per capita, 2020: $5,480 (417.0% increase since 2003)

- Student debt per capita, 2003: $1,060

- Total number of borrowers, 2020: 832,200 ($35,100 average debt per borrower)

Kate Kultsevych // Shutterstock- Student debt per capita, 2020: $5,480 (417.0% increase since 2003)

- Student debt per capita, 2003: $1,060

- Total number of borrowers, 2020: 832,200 ($35,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $6,050 (426.1% increase since 2003)

- Student debt per capita, 2003: $1,150

- Total number of borrowers, 2020: 1,709,100 ($37,300 average debt per borrower)

ESB Professional // Shutterstock- Student debt per capita, 2020: $6,050 (426.1% increase since 2003)

- Student debt per capita, 2003: $1,150

- Total number of borrowers, 2020: 1,709,100 ($37,300 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJacob Lund // Shutterstock

- Student debt per capita, 2020: $3,540 (428.4% increase since 2003)

- Student debt per capita, 2003: $670

- Total number of borrowers, 2020: 54,600 ($30,100 average debt per borrower)

Jacob Lund // Shutterstock- Student debt per capita, 2020: $3,540 (428.4% increase since 2003)

- Student debt per capita, 2003: $670

- Total number of borrowers, 2020: 54,600 ($30,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $6,400 (428.9% increase since 2003)

- Student debt per capita, 2003: $1,210

- Total number of borrowers, 2020: 1,828,100 ($34,500 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $6,400 (428.9% increase since 2003)

- Student debt per capita, 2003: $1,210

- Total number of borrowers, 2020: 1,828,100 ($34,500 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $6,030 (438.4% increase since 2003)

- Student debt per capita, 2003: $1,120

- Total number of borrowers, 2020: 1,434,200 ($35,900 average debt per borrower)

ESB Professional // Shutterstock- Student debt per capita, 2020: $6,030 (438.4% increase since 2003)

- Student debt per capita, 2003: $1,120

- Total number of borrowers, 2020: 1,434,200 ($35,900 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparel i g h t p o e t // Shutterstock

- Student debt per capita, 2020: $5,890 (440.4% increase since 2003)

- Student debt per capita, 2003: $1,090

- Total number of borrowers, 2020: 555,300 ($37,200 average debt per borrower)

l i g h t p o e t // Shutterstock- Student debt per capita, 2020: $5,890 (440.4% increase since 2003)

- Student debt per capita, 2003: $1,090

- Total number of borrowers, 2020: 555,300 ($37,200 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJacob Lund // Shutterstock

- Student debt per capita, 2020: $4,270 (447.4% increase since 2003)

- Student debt per capita, 2003: $780

- Total number of borrowers, 2020: 318,400 ($32,400 average debt per borrower)

Jacob Lund // Shutterstock- Student debt per capita, 2020: $4,270 (447.4% increase since 2003)

- Student debt per capita, 2003: $780

- Total number of borrowers, 2020: 318,400 ($32,400 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $6,910 (452.8% increase since 2003)

- Student debt per capita, 2003: $1,250

- Total number of borrowers, 2020: 871,500 ($42,600 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $6,910 (452.8% increase since 2003)

- Student debt per capita, 2003: $1,250

- Total number of borrowers, 2020: 871,500 ($42,600 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareGirts Ragelis // Shutterstock

- Student debt per capita, 2020: $6,190 (457.7% increase since 2003)

- Student debt per capita, 2003: $1,110

- Total number of borrowers, 2020: 1,159,300 ($38,200 average debt per borrower)

Girts Ragelis // Shutterstock- Student debt per capita, 2020: $6,190 (457.7% increase since 2003)

- Student debt per capita, 2003: $1,110

- Total number of borrowers, 2020: 1,159,300 ($38,200 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $4,630 (457.8% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 462,700 ($31,800 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $4,630 (457.8% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 462,700 ($31,800 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJacob Lund // Shutterstock

- Student debt per capita, 2020: $5,310 (458.9% increase since 2003)

- Student debt per capita, 2003: $950

- Total number of borrowers, 2020: 935,700 ($32,300 average debt per borrower)

Jacob Lund // Shutterstock- Student debt per capita, 2020: $5,310 (458.9% increase since 2003)

- Student debt per capita, 2003: $950

- Total number of borrowers, 2020: 935,700 ($32,300 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparel i g h t p o e t // Shutterstock

- Student debt per capita, 2020: $5,160 (467.0% increase since 2003)

- Student debt per capita, 2003: $910

- Total number of borrowers, 2020: 3,614,000 ($32,800 average debt per borrower)

l i g h t p o e t // Shutterstock- Student debt per capita, 2020: $5,160 (467.0% increase since 2003)

- Student debt per capita, 2003: $910

- Total number of borrowers, 2020: 3,614,000 ($32,800 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareFlamingo Images // Shutterstock

- Student debt per capita, 2020: $5,780 (483.8% increase since 2003)

- Student debt per capita, 2003: $990

- Total number of borrowers, 2020: 626,300 ($34,900 average debt per borrower)

Flamingo Images // Shutterstock- Student debt per capita, 2020: $5,780 (483.8% increase since 2003)

- Student debt per capita, 2003: $990

- Total number of borrowers, 2020: 626,300 ($34,900 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareHead over Heels // Shutterstock

- Student debt per capita, 2020: $4,030 (492.6% increase since 2003)

- Student debt per capita, 2003: $680

- Total number of borrowers, 2020: 71,200 ($33,500 average debt per borrower)

Head over Heels // Shutterstock- Student debt per capita, 2020: $4,030 (492.6% increase since 2003)

- Student debt per capita, 2003: $680

- Total number of borrowers, 2020: 71,200 ($33,500 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJacob Lund // Shutterstock

- Student debt per capita, 2020: $5,280 (500.0% increase since 2003)

- Student debt per capita, 2003: $880

- Total number of borrowers, 2020: 601,500 ($37,100 average debt per borrower)

Jacob Lund // Shutterstock- Student debt per capita, 2020: $5,280 (500.0% increase since 2003)

- Student debt per capita, 2003: $880

- Total number of borrowers, 2020: 601,500 ($37,100 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareSeventyFour // Shutterstock

- Student debt per capita, 2020: $6,320 (501.9% increase since 2003)

- Student debt per capita, 2003: $1,050

- Total number of borrowers, 2020: 1,345,400 ($36,500 average debt per borrower)

SeventyFour // Shutterstock- Student debt per capita, 2020: $6,320 (501.9% increase since 2003)

- Student debt per capita, 2003: $1,050

- Total number of borrowers, 2020: 1,345,400 ($36,500 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparefizkes // Shutterstock

- Student debt per capita, 2020: $5,140 (511.9% increase since 2003)

- Student debt per capita, 2003: $840

- Total number of borrowers, 2020: 2,593,800 ($38,300 average debt per borrower)

fizkes // Shutterstock- Student debt per capita, 2020: $5,140 (511.9% increase since 2003)

- Student debt per capita, 2003: $840

- Total number of borrowers, 2020: 2,593,800 ($38,300 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepare4 PM production // Shutterstock

- Student debt per capita, 2020: $4,490 (515.1% increase since 2003)

- Student debt per capita, 2003: $730

- Total number of borrowers, 2020: 334,300 ($35,000 average debt per borrower)

4 PM production // Shutterstock- Student debt per capita, 2020: $4,490 (515.1% increase since 2003)

- Student debt per capita, 2003: $730

- Total number of borrowers, 2020: 334,300 ($35,000 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can preparefizkes // Shutterstock

- Student debt per capita, 2020: $6,270 (520.8% increase since 2003)

- Student debt per capita, 2003: $1,010

- Total number of borrowers, 2020: 540,900 ($35,700 average debt per borrower)

fizkes // Shutterstock- Student debt per capita, 2020: $6,270 (520.8% increase since 2003)

- Student debt per capita, 2003: $1,010

- Total number of borrowers, 2020: 540,900 ($35,700 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJoyseulay // Shutterstock

- Student debt per capita, 2020: $5,170 (522.9% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 579,600 ($32,900 average debt per borrower)

Joyseulay // Shutterstock- Student debt per capita, 2020: $5,170 (522.9% increase since 2003)

- Student debt per capita, 2003: $830

- Total number of borrowers, 2020: 579,600 ($32,900 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMuk Photo // Shutterstock

- Student debt per capita, 2020: $6,380 (544.4% increase since 2003)

- Student debt per capita, 2003: $990

- Total number of borrowers, 2020: 133,500 ($36,800 average debt per borrower)

Muk Photo // Shutterstock- Student debt per capita, 2020: $6,380 (544.4% increase since 2003)

- Student debt per capita, 2003: $990

- Total number of borrowers, 2020: 133,500 ($36,800 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareDrazen Zigic // Shutterstock

- Student debt per capita, 2020: $5,210 (551.3% increase since 2003)

- Student debt per capita, 2003: $800

- Total number of borrowers, 2020: 851,100 ($35,500 average debt per borrower)

Drazen Zigic // Shutterstock- Student debt per capita, 2020: $5,210 (551.3% increase since 2003)

- Student debt per capita, 2003: $800

- Total number of borrowers, 2020: 851,100 ($35,500 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareJack Frog // Shutterstock

- Student debt per capita, 2020: $4,650 (554.9% increase since 2003)

- Student debt per capita, 2003: $710

- Total number of borrowers, 2020: 366,600 ($32,300 average debt per borrower)

Jack Frog // Shutterstock- Student debt per capita, 2020: $4,650 (554.9% increase since 2003)

- Student debt per capita, 2003: $710

- Total number of borrowers, 2020: 366,600 ($32,300 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareSingingMedia // Shutterstock

- Student debt per capita, 2020: $7,610 (585.6% increase since 2003)

- Student debt per capita, 2003: $1,110

- Total number of borrowers, 2020: 1,599,800 ($41,200 average debt per borrower)

SingingMedia // Shutterstock- Student debt per capita, 2020: $7,610 (585.6% increase since 2003)

- Student debt per capita, 2003: $1,110

- Total number of borrowers, 2020: 1,599,800 ($41,200 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareShift Drive // Shutterstock

- Student debt per capita, 2020: $5,550 (611.5% increase since 2003)

- Student debt per capita, 2003: $780

- Total number of borrowers, 2020: 1,333,600 ($36,400 average debt per borrower)

Shift Drive // Shutterstock- Student debt per capita, 2020: $5,550 (611.5% increase since 2003)

- Student debt per capita, 2003: $780

- Total number of borrowers, 2020: 1,333,600 ($36,400 average debt per borrower)

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareMonkey Business Images // Shutterstock

- Student debt per capita, 2020: $6,060 (648.1% increase since 2003)

- Student debt per capita, 2003: $810

- Total number of borrowers, 2020: 414,700 ($36,900 average debt per borrower)

Monkey Business Images // Shutterstock- Student debt per capita, 2020: $6,060 (648.1% increase since 2003)

- Student debt per capita, 2003: $810

- Total number of borrowers, 2020: 414,700 ($36,900 average debt per borrower)

-

-

Biden still plans to restart federal student loan payments in February. Here’s how you can prepareESB Professional // Shutterstock

- Student debt per capita, 2020: $6,070 (754.9% increase since 2003)

- Student debt per capita, 2003: $710

- Total number of borrowers, 2020: 736,400 ($36,800 average debt per borrower)

This story originally appeared on StudySoup and was produced and distributed in partnership with Stacker Studio.

ESB Professional // Shutterstock- Student debt per capita, 2020: $6,070 (754.9% increase since 2003)

- Student debt per capita, 2003: $710

- Total number of borrowers, 2020: 736,400 ($36,800 average debt per borrower)

This story originally appeared on StudySoup and was produced and distributed in partnership with Stacker Studio.